Author: Naresh Singaravelu (Commentary)

Editor(s): Riya Singh Rathore

INTRODUCTION

Ayushman Bharat, an umbrella scheme that included other major Publicly Funded Health Insurances [PFHI] schemes, was launched in 2018 by the Union government. The vision was one of achieving universal health coverage (National Health Authority, n.d.). The flagship scheme contains two components, health and wellness centres [HWCs] and the Pradhan Mantri Jan Arogya Yojana [PMJAY] (ibid.). The former involves upgrading existing sub-health centres and primary health centres into HWCs to enhance maternal and child healthcare, and prevent non-communicable diseases. The latter component aims at providing a cover of 5 lakh rupees per family per year for secondary and tertiary care hospitalisation (ibid.).

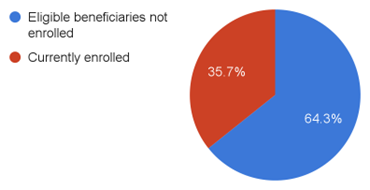

With nearly 50 crore potential beneficiaries and a higher annual cover compared to the existing PFHI schemes, PMJAY is touted as the largest health insurance scheme in the world (ibid.). Yet, as of March 2022, only 17.86 crore individual Ayushman cards have been issued (ibid.), which covers just over a third of the potential beneficiaries envisioned by the scheme.

Figure 1: Progress of beneficiary enrollment under PMJAY (as of March 2022)

Source: National Health Authority (n.d.)

Source: National Health Authority (n.d.)

According to the latest National Family Health Survey-5 conducted between 2019 and 2021, only 41% of the households in the country have only one member covered by a health insurance or financing scheme (International Institute for Population Sciences, 2021).

The National Health Mission defines out-of-pocket expenditure [OOPE] as the spending that households directly make when receiving healthcare (National Health Accounts Technical Secretariat, 2021). OOPE indicates the level of financial protection available to households. The higher the OOPE, the more drastic the economic impact of health spending on a family.

Evidence shows that for those below the poverty line, enrollment in a PFHI scheme leads to reduced mortality rates arising from medical conditions covered by the schemes and lower out-of-pocket expenses for hospital admission (Sood et al., 2014). An association between enrollment in a PFHI scheme and increased hospitalisation rates, especially in rural areas, has also been observed (Ranjan et al., 2018).

The positive effects associated with enrollment in a PFHI scheme show that enrollment in health insurance programmes that are designed and implemented well leads to increased access to healthcare facilities, especially in middle and low-income countries, and improved financial protection (Erlangga et al., 2019). The paper aims to examine the effectiveness of Ayushman Bharat-PMJAY in increasing the financial security of its beneficiaries. It will also focus on the role of PMJAY since the onset of the pandemic.

THE IMPORTANCE OF REDUCING OOPE

Responding to a question regarding the role of PMJAY in curtailing OOPE, the Minister of State [MoS] for Health and Family Welfare pegged the value of authorised hospital admission under PMJAY at 37,185 crore rupees since its inception in FY 2018-19. The MoS said that “if these services were availed by beneficiaries on their own, it would have resulted in out-of-pocket expenditure to the tune of 1.5 to 2 times the expenditure incurred under the scheme” (Pawar, 2022). While this illustrates the financial impact that the scheme has created, a closer examination is needed to gauge the success in reducing the burden of out-of-pocket expenditure that continues to affect the healthcare system.

Though out-of-pocket spending as a share of total health expenditure in the country has been on a decline since 2013, it remains at a sizable 48.8% (National Health Accounts Technical Secretariat, 2021). The 15th Finance Commission had also flagged the level of OOPE in India as among the highest in the world (XV Finance Commission, 2020, p. 264).

The financial burden on households due to OOPE can often become “catastrophic”, especially among the poor. The World Health Organization [WHO] considers a health expense as “catastrophic” if it accounts for more than 10% of the patient’s overall household income (Shrime, 2021; World Health Organization, n.d.) or if it exceeds 40% of the household’s capacity to pay (Xu et al., 2003).

The proportion of households experiencing catastrophic health expenditure in India has increased since the early 1990s, and this increase is more significant among the poorer families (Pandey et al., 2018). It has been estimated that about 8% of the population in the country falls below the poverty line due to high out-of-pocket health expenditure, and this proportion increases when the head of the household is not educated (Kumar et al., 2015). Further, according to the 15th Finance Commission, OOPE pushes about 6 crore Indians into poverty each year (XV Finance Commission, 2020, p. 266).

Health insurance is an important policy tool to prevent catastrophic health expenditure and ensure protection from the high healthcare costs. Taking this into account, India has formulated several PFHI schemes to achieve financial health protection. Among the earliest PFHI schemes was the Employees’ State Insurance Scheme [ESIS], launched in the late 1940s for workers employed in the private sector (Forgia & Nagpal, 2012, p. 27). The scheme provides comprehensive coverage, including both preventive and primary healthcare services (ibid.). ESIS covers workers earning up to 21,000 rupees working in specific establishments defined in the Employees State Insurance Act, 1948 (Ministry of Labour and Employment, n.d. a). Hence, the scheme is limited in terms of its beneficiary coverage. The scheme has meagre utilisation rates, with beneficiaries resorting to self-medication or not seeking healthcare (Dash & Muraleedharan, 2011). The reasons for this included lack of accessible ESI facilities, long waiting period, and dissatisfaction with the quality of treatment (ibid.). This discontent resulted in a dependence on costlier private healthcare facilities, leading to increased OOPE (ibid.).

A more recent PFHI scheme, the Rashtriya Swasthya Bima Yojana [RSBY] was launched in 2008. Unlike ESIS, RSBY did not have comprehensive coverage. It provided insurance coverage of 30,000 rupees for inpatient care to families below the poverty line (Karan et al., 2017). The scheme saw an enrollment of around 3.6 crore BPL families as of 2013 and covered about 65 lakh hospitalisations (Ministry of Health & Family Welfare, 2014). But, a study established that the scheme had no effect in reducing catastrophic health expenditure (Ghosh & Gupta, 2017). The reasons for this include expenditure on medicines and diagnostics and exclusion of outpatient care from insurance coverage (Ibid). Another study showed that the scheme is in fact associated with an increase in OOPE, primarily due to beneficiaries being persuaded by healthcare providers to utilise inpatient services not covered under RSBY(Karan et al., 2017).

Impact of PMJAY

PMJAY, introduced in 2018, was touted to play a significant role in enabling better protection from health-related financial risk. For one, the scheme targeted a broader range of beneficiaries, including more poor and vulnerable households that were identified based on deprivation and occupational criteria in the Socio-Economic Caste Census 2011 (National Health Authority, n.d.). The scheme’s financial coverage was expanded more than sixteen-fold from 30,000 rupees in RSBY to 5,00,000 rupees (ibid.). Another significant feature of PMJAY is that it does not impose an upper limit on the number of members in a household, ensuring that nobody gets excluded (ibid.). The transition from RSBY to PMJAY has thus resulted in better coverage, made evident by the increase in the enrollment of beneficiaries and the number of empanelled hospitals (ibid.).

RSBY covered only a narrow range of secondary and tertiary care services (Lahariya, 2018) and excluded outpatient expenditure, accounting for a majority share of the OOPE (National Health Accounts Technical Secretariat, 2016). RSBY’s drawbacks regarding service coverage carried over to PMJAY. PMJAY also covers only secondary and tertiary care services, meaning that it excludes major contributors to the OOPE such as outpatient consultations, medicines and diagnostic treatments (National Health Authority, n.d.).The financial impact of this is significant. Nearly 55% of the OOPE is spent on outpatient care (National Health Accounts Technical Secretariat, 2016). Further, while 53% of the total OOPE is spent on medicines (over-the-counter or as part of treatment), 82% of this expenditure on medicines is incurred as part of outpatient care (ibid.). Similarly, 67% of the total diagnostic spending, which accounts for 10% of the total OOPE, is incurred for outpatient care. In contrast, spending on inpatient care, which is covered by the scheme, constitutes less than a third of the total OOPE (ibid.).

While PMJAY provides access to secondary and tertiary healthcare services, it excludes primary care, accounting for 47% of the current health expenditure (National Health Accounts Technical Secretariat, 2021). Despite focusing on secondary and tertiary care, research conducted in Chhattisgarh has shown that enrollment in PMJAY was not associated with an increase in the hospitalisation rate (Garg et al., 2020). This is at odds with previous research that showed that enrollment in PFHI schemes is associated with increased hospitalisation rates (Ranjan et al., 2018), as seen earlier.

The exclusion of primary healthcare and outpatient services explains why studies analysing the impact of PMJAY on OOPE have shown that the increased financial cover and beneficiary coverage notwithstanding, the scheme has not led to a decrease in the incidence of catastrophic level health expenditure (Bala et al., 2021; S. Garg et al., 2020). Other than flaws in the scheme’s design detailed above, the reason for the lack of large-scale impact on OOPE could be due to various other reasons such as lack of awareness among beneficiaries (Bala et al., 2021), and discrepancies in official data on PFHI cards and actual coverage reported by households (Hooda, 2020a).

These findings gained special significance after the onset of the COVID-19 pandemic and the increased rate of hospitalisation caused by it. To strengthen its response to the disease, the government made free testing and treatment for COVID-19 available under PMJAY in April 2020 (Ministry of Health & Family Welfare, 2020). Contrary to expectations, data from the National Health Authority show a sharp decline in authorised admissions under PMJAY in the first quarter of the financial year 2020-21. It fell from 22 lakh the previous quarter to 13 lakh in April, May, and June 2020 (National Health Authority, 2021).

The Health Ministry had indicated that about 20-25% of the cases required hospitalisation at the pandemic’s peak (ANI, 2022). However, in an RTI response, the National Health Authority revealed that only 9.3 lakh persons hospitalised due to COVID-19 until 31 December 2021 were treated free of cost under PMJAY. This figure accounts for just about 12% of the total hospitalisations as per the Health Ministry’s estimates (Barnagarwala, 2022). Moreover, as of 31 December 2021, a total of 55.28 lakh people had been tested for free for COVID-19 under the scheme, which accounted for barely 16% of the total tests conducted in the country at that point (ibid.). Another independent analysis had concluded that between January 2020 and June 2021, only 5% of the total hospitalisations under PMJAY were for COVID-19 treatment (Dutta, 2021).

However, these findings were not uniform across all states. A study conducted in a hospital in Kashmir found that PMJAY beneficiaries were able to eliminate distress financing in tertiary healthcare (Khan et al., 2021). Similarly, data from Karnataka and Meghalaya show that PMJAY has improved maternal and child health, nutritional status, and treatment of childhood diseases (Majumder et al., 2022). While some of the improvements were due to the increased access to healthcare facilities enabled by the scheme, the study finds that state-specific schemes are more effective in achieving better health outcomes (ibid).

Even during the pandemic, the scheme was better utilised in some states than others. For instance, a study conducted in a private hospital in Karnataka found the utilisation rate of Ayushman Bharat (called Ayushman Bharat Arogya Karnataka in the state) among COVID-19 patients to be as high as 78% (Shrisharath et al., 2022).

The Way Forward

Despite several shortcomings in its implementation and design, evidence of successful outcomes in some states shows demonstrable potential for PMJAY to reduce OOPE and increase financial protection.

To achieve this, there is a need to examine the challenges which have plagued PFHI schemes for years and continue to affect PMJAY, such as discrepancies in enrollment, non-inclusion of outpatient care, and lack of information dissemination among beneficiaries. The success of state-specific health insurance schemes among those states that are not implementing PMJAY needs to be examined further to gauge how to alter the design of the scheme according to the specific needs and health infrastructure (Majumder et al., 2022).

There is a need to increase the coverage of services to outpatient care. Given that over 90% of the claims under the schemes were less than 30,000 rupees (Hooda, 2020b), the present 5 lakh cover will be sufficient to accommodate the possible inclusion of outpatient services.

The disproportionate focus on the insurance component of Ayushman Bharat, compared to the HWC component, has also been criticised (Bhaduri, 2021). As seen above, PMJAY focuses on secondary and tertiary healthcare while neglecting primary care. Data shows at least a 29% shortfall in the number of PHCs required to effectively serve the population as per prescribed norms, and a 38% shortfall in terms of CHCs (Government of India, 2019). The shortfall is stark in states like Bihar (53% shortfall for PHCs, 94% for CHCs), Madhya Pradesh (47% for PHCs, 45% for CHCs), and Uttar Pradesh (51% each). On the other hand, in states such as Tamil Nadu and Kerala, there is no shortfall in the provisioning of PHCs or CHCs (ibid.).

Unsurprisingly, the latter two states have the lowest infant mortality, neonatal mortality, under-5 mortality, and the lowest maternal mortality rates (Government of India, 2018). This once again brings into question the need to understand state-specific healthcare strategies and focus on primary healthcare to improve overall health outcomes and decrease the dependence of households on preventive care and high OOPE levels.

Most importantly, there is an immediate need to increase public expenditure on health. According to the Economic Survey 2020-21 published by the Chief Economic Advisor (2021), an increase in public health expenditure from the current 1% of the GDP to 2.5-3% can lead to a reduction in OOPE to 30% of total spending on health from the current 48.8% .

In sum, there is an urgent need to broaden the extent of services covered under India’s flagship health insurance scheme, and to focus on the primary healthcare system in order to effectively enable financial protection for the vulnerable.

References

ANI [@ANI]. (2022, January 10). In the present surge, 5-10% of active cases needed hospitalisation so far. The situation is dynamic & evolving, the need [Tweet]. Twitter. https://twitter.com/ANI/status/1480484112599162892.

Bala, R., Kumar, M., Krishna, K. K., & Devi, C. S. (2021). Has Ayushman Bharat Dwindled the Out-of-Pocket Expenditure? Journal of Evolution of Medical and Dental Sciences, 10(25), 1895–1898. https://doi.org/10.14260/jemds/2021/391.

Barnagarwala, T. (2022, March 24). The pandemic’s hidden cost: Much-hyped health insurance scheme failed to cover hospital bills. Scroll.In. https://scroll.in/article/1020201/the-pandemics-hidden-cost-much-hyped-health-insurance-scheme-failed-to-cover-hospital-bills.

Chief Economic Advisor. (2021). Economic Survey 2020-21: Volume 1. Ministry of Finance, Government of India. https://www.indiabudget.gov.in/budget2021-22/economicsurvey/doc/vol1chapter/echap05_vol1.pdf.

Dash, U., & Muraleedharan, V. R. (2011). How Equitable is Employees’ State Insurance Scheme in India?: A Case Study of Tamil Nadu. Consortium for Research on Equitable Health Systems. https://assets.publishing.service.gov.uk/media/57a08acfe5274a31e00007b8/india_esis_12jul.pdf.

Dutta, S. S. (2021, November 14). At peak of pandemic, only five per cent of hospitalisations under PMJAY: Study. The New Indian Express. https://www.newindianexpress.com/thesundaystandard/2021/nov/14/at-peak-of-pandemic-only-five-per-cent-of-hospitalisations-under-pmjay-study-2383291.html.

Erlangga, D., Suhrcke, M., Ali, S., & Bloor, K. (2019). The impact of public health insurance on health care utilisation, financial protection and health status in low- and middle-income countries: A systematic review. PLOS ONE, 14(8), e0219731. https://doi.org/10.1371/journal.pone.0219731.

Forgia, G. L., & Nagpal, S. (2012). Government-Sponsored Health Insurance in India: Are You Covered?. World Bank Publications. https://openknowledge.worldbank.org/handle/10986/11957.

Garg, C. C., John, P., & Mokashi, T. (2021). Methods and Measurement of Primary, Secondary and Tertiary Healthcare Expenditures in India During 2013–2014 to 2016–2017. Indian Journal of Human Development, 15(3), 379–394. https://doi.org/10.1177/09737030211047030.

Garg, S., Bebarta, K. K., & Tripathi, N. (2020). Performance of India’s national publicly funded health insurance scheme, Pradhan Mantri Jan Arogaya Yojana (PMJAY), in improving access and financial protection for hospital care: Findings from household surveys in Chhattisgarh state. BMC Public Health, 20(1), 949. https://doi.org/10.1186/s12889-020-09107-4.

Ghosh, S., & Gupta, N. D. (2017). Targeting and Effects of Rashtriya Swasthya Bima Yojana on Access to Care and Financial Protection. Economic and Political Weekly, 52(4), 7–8.

Government of India. (2018). Sample Registration System Statistical Report. https://censusindia.gov.in/nada/index.php/catalog/34782/download/38470/SRS_STAT_2018.pdf.

Government of India. (2019). Rural Health Statistics. Ministry of Health and Family Welfare. https://main.mohfw.gov.in/sites/default/files/Final%20RHS%202018-19_0.pdf.

Hooda, S. K. (2020a). Penetration and coverage of government-funded health insurance schemes in India. Clinical Epidemiology and Global Health, 8(4), 1017–1033. https://doi.org/10.1016/j.cegh.2020.03.014.

Hooda, S. K. (2020b). Decoding Ayushman Bharat. Economic and Political Weekly, 55(25), 7–8.

International Institute for Population Sciences. (2021). National Family Health Survey—5 (2019-2021). Ministry of Health and Family Welfare. http://rchiips.org/nfhs/NFHS-5_FCTS/India.pdf.

Karan, A., Yip, W., & Mahal, A. (2017). Extending health insurance to the poor in India: An impact evaluation of Rashtriya Swasthya Bima Yojana on out of pocket spending for healthcare. Social Science & Medicine, 181, 83–92. https://doi.org/10.1016/j.socscimed.2017.03.053.

Kumar, K., Singh, A., Kumar, S., Ram, F., Singh, A., Ram, U., Negin, J., & Kowal, P. R. (2015). Socio-Economic Differentials in Impoverishment Effects of Out-of-Pocket Health Expenditure in China and India: Evidence from WHO SAGE. PloS One, 10(8), e0135051. https://doi.org/10.1371/journal.pone.0135051.

Lahariya, C. (2018). ‘Ayushman Bharat’ Program and Universal Health Coverage in India. Indian Pediatrics, 55(6), 495–506. https://doi.org/10.1007/s13312-018-1341-1.

Majumder, A., Oswal, V., Kele, M., Kabra, S., & Lokunde, S. H. (2022). Analyzing the Impact of Universal Health Coverage (AB-PMJAY) on Health Outcomes of Women and Children in Selected Indian States (SSRN Scholarly Paper ID 4043445). Social Science Research Network. https://doi.org/10.2139/ssrn.4043445.

Ministry of Health & Family Welfare. (2014, January 8). Rashtriya Swasthya Bima Yojana—Overview. https://web.archive.org/web/20140108131843/http://www.rsby.gov.in/Overview.aspx.

Ministry of Health & Family Welfare. (2020, April 4). Testing and treatment of COVID -19 now available for free under Ayushman Bharat Pradhan Mantri Jan Arogya Yojana. PMJAY. https://pmjay.gov.in/sites/default/files/2020-04/Testing-and-Treatment-of-COVID-19-under-AB-PM-JAY_1.pdf.

Ministry of Labour and Employment. (n.d. a). Coverage | Employee’s State Insurance Corporation. Employee’s State Insurance Corporation. https://www.esic.nic.in/coverage.

Ministry of Labour and Employment. (n.d. b). In-Patient Treatment | Employee’s State Insurance Corporation. Employee’s State Insurance Corporation. https://www.esic.nic.in/in-patient-treatment.

National Health Accounts Technical Secretariat. (2016). Household Health Expenditures in India (2013-14). Ministry of Health and Family Welfare. https://main.mohfw.gov.in/sites/default/files/38300411751489562625.pdf.

National Health Accounts Technical Secretariat. (2021). National Health Accounts Estimates for India FY 2017-18. Ministry of Health and Family Welfare. https://nhsrcindia.org/sites/default/files/2021-11/National%20Health%20Accounts-%202017-18.pdf.

National Health Authority. (2021, August 18). Progress of Ayushman Bharat PM-JAY. https://pmjay.gov.in/sites/default/files/2021-08/2-Cr-Event-PPT-FINAL.pdf

National Health Authority. (n.d.). https://pmjay.gov.in/about/pmjay.

Pandey, A., Ploubidis, G. B., Clarke, L., & Dandona, L. (2018). Trends in catastrophic health expenditure in India: 1993 to 2014. Bulletin of the World Health Organization, 96(1), 18–28. https://doi.org/10.2471/BLT.17.191759.

Pawar, B. (2022, March 25). Lok Sabha—Unstarred Question Number 3885: Role of AB-PMJAY in curtailing Out-of-Pocket Expenditure. Lok Sabha. http://164.100.47.194/Loksabha/Questions/QResult15.aspx?qref=36530&lsno=17.

Ranjan, A., Dixit, P., Mukhopadhyay, I., & Thiagarajan, S. (2018). Effectiveness of government strategies for financial protection against costs of hospitalization Care in India. BMC Public Health, 18(1), 1–12. https://doi.org/10.1186/s12889-018-5431-8.

Shrime, M. G. (2021, February 19). Catastrophic expenditure for health: From antiquity to today. World Bank Blogs. https://blogs.worldbank.org/opendata/catastrophic-expenditure-health-antiquity-today.

Shrisharath, K., Hiremat, S., Nanjesh Kumar, S., Rai, P., Erappa, S., & Holla, A. (2022). A study on the utilisation of Ayushman Bharat Arogya Karnataka (ABArK) among COVID patients admitted in a Tertiary Care Hospital. Clinical Epidemiology and Global Health, 15, 101015. https://doi.org/10.1016/j.cegh.2022.101015.

Sood, N., Bendavid, E., Mukherji, A., Wagner, Z., Nagpal, S., & Mullen, P. (2014). Government health insurance for people below poverty line in India: Quasi-experimental evaluation of insurance and health outcomes. BMJ, 349, g5114. https://doi.org/10.1136/bmj.g5114.

World Health Organization. (n.d.). SDG Target 3.8. World Health Organization. https://www.who.int/data/gho/data/themes/topics/indicator-groups/indicator-group-details/GHO/sdg-target-3.8-achieve-universal-health-coverage-(uhc)-including-financial-risk-protection.

Xu, K., Evans, D. B., Kawabata, K., Zeramdini, R., Klavus, J., & Murray, C. J. L. (2003). Household catastrophic health expenditure: A multicountry analysis. Lancet (London, England), 362(9378), 111–117. https://doi.org/10.1016/S0140-6736(03)13861-5.

XV Finance Commission. (2020). Finance Commission in COVID Times: Report for 2021-26. (Volume-I Main Report). XV Finance Commission.

https://fincomindia.nic.in/WriteReadData/html_en_files/fincom15/Reports/XVFC%20VOL%20I%20Main%20Report.pdf.