Among developed nations, the European Union (EU) has remained at the forefront of environmental protection, distinguished through proactive and legally binding measures. While many countries have set ambitious climate targets, the EU has gone a step further by enacting comprehensive policies that drive sustainable practices both within its borders and globally.

The European Green Deal, for example, commits the EU to becoming climate-neutral by 2050, integrating sustainability into economic and trade policies (European Commission, 2019). The EU Deforestation Regulation is also a landmark policy adopted by the EU in 2023 to combat global deforestation, whether legal or illegal. The regulation applies to commodities such as cocoa, coffee, palm oil, rubber, soy, timber, and derived products like leather, chocolate, and furniture (EUDR, 2024), and can be placed on products that are entering from the EU market if they are linked to deforestation or land degradation after December 31, 2020.

Some key factors related to the EUDR are:

1. Compliance with Local and Environmental Laws

The EUDR makes it necessary that the products are produced per the relevant legislation of the country of production concerning the legal status of the area of production in terms of land use rights, environmental protections, and conservation practices (Forwood et al., 2024). This makes it mandatory for the producers to carry out due diligence practices. The due diligence responsibility will lie with the enterprises that are not considered SMEs and the operators.

Potential fines

The EU DR has also introduced non-compliance penalties, where companies will be fined based on the environmental harm caused and the value of non-compliant products. These fines will increase with repeated violations, with a maximum penalty of 4% of the company’s EU turnover from the previous year. In some cases, fines may be raised beyond the economic benefit gained from non-compliance (Forwood et al., 2024).

3. Regular checks from National Authorities and Scrutiny by Private Parties

It will also strictly enforce national authorities’ checks in EU Member States. There will be regular and unannounced checks on businesses to ensure compliance with the EUDR regulation within member states. If any product is deemed high risk, authorities can impose remedial measures to prevent it from entering the market. Corrective actions such as resolving formal issues or facing a ban on sales of products and exports within a set timeframe may also be imposed on enterprises (Forwood et al., 2024).

4. Company sizes

The EU Deforestation Regulation is set to be implemented by December 30, 2025 for large companies and June 30, 2026 for micro and small companies. Under the Regulation, a large company is defined as one that meets at least two requirements as follows: an annual turnover of more than €50 million, more than 250 employees, or an annual balance sheet exceeding a total of €43 million (TDS, 2025). A small company, on the other hand, will be one with fewer than 50 employees and either an annual turnover or an annual balance sheet total not exceeding €10 million.

5. Geotagging and Traceability

The Regulation requires that the products that are imported to the EU market must possess geotags. Geotagging is the information related to the geolocation data of the commodities. This is to make sure that the products are not linked to deforestation. In India, this becomes a challenge due to the lack of implementation systems as well as the unique composition of the manufacturing sector which comprises several small-scale farmers and intermediaries.

Supply Chains Affected

This regulation introduces new challenges and opportunities for Indian businesses. On one hand, industries will need to adopt traceability measures, invest in sustainable sourcing, and comply with due diligence to maintain market access. On the other hand, adherence to the EUDR can enhance India’s reputation for sustainable trade, offering a competitive advantage in the global supply chain. However, this can come at a high cost for supply chains directly affected by these regulations.

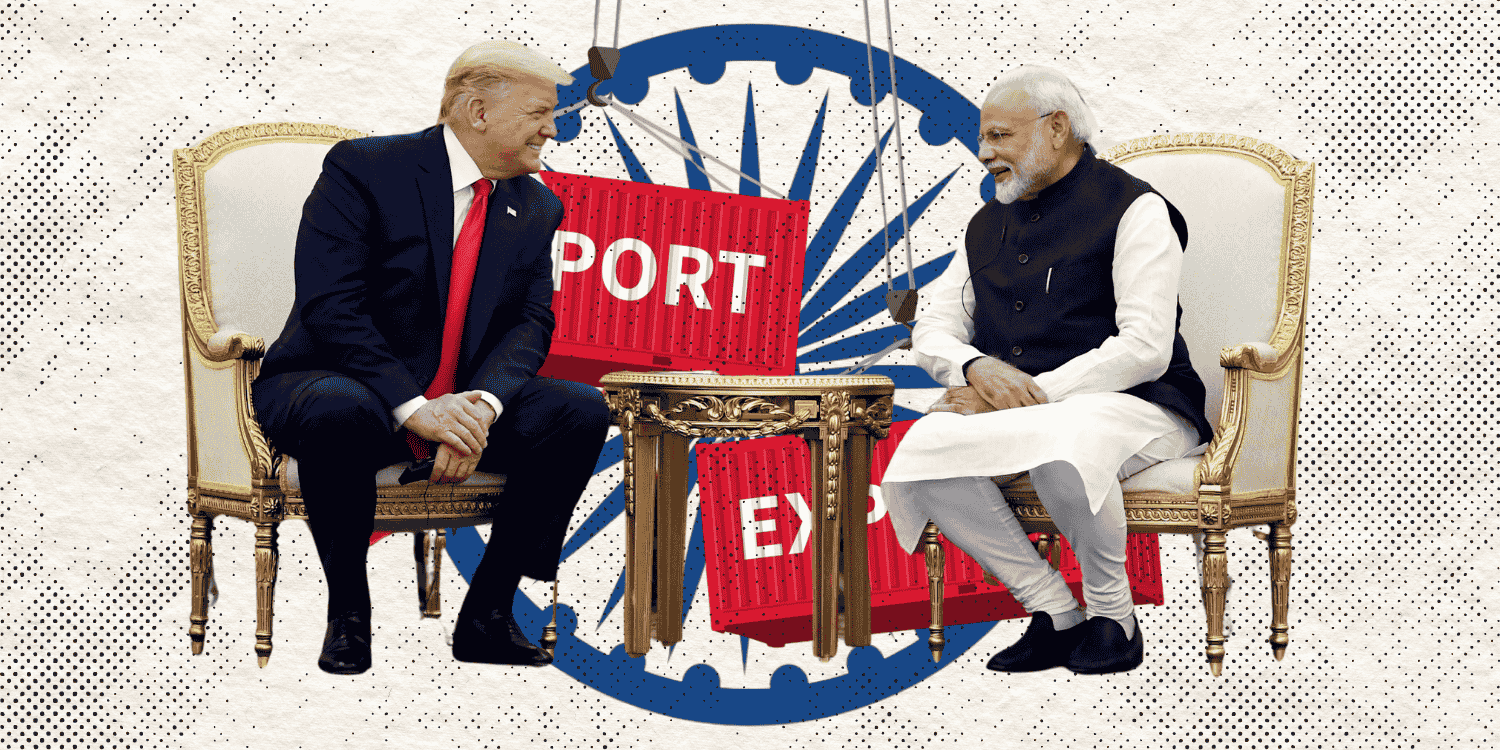

The EU is a critical trading partner for India—thus, these regulations directly impact multiple sectors. Over the last few years, India’s exports to the EU market have constituted a share of roughly 17.8-7.37% of the country’s total exports, making it one of the largest importers of Indian goods (GOI, 2024). The two have also partnered to deepen their bilateral relations and develop strategic convergence to promote global stability, economic security, and focus on critical links especially related to trade and technology cooperation. These partnerships have translated into the form of the EU-India Trade and Technology Council (EU Commission, 2025). Given this strong trade relationship, it is essential to examine how these regulations impact key sectors of India’s economy, particularly those heavily reliant on EU exports.

EU Product Imports from India 2022

EU Product Imports from India 2022

Source: World Integrated Trade Solution, World Bank

i. Leather

India is a significant producer and exporter of leather products. Approximately 12.9% of the global leather production of hides and 9% of global footwear production can be attributed to the Indian leather industry, making India the 4th largest exporter of leather (ARISA, 2021). The EUDR directly affects leather export since major importers of leather from India include countries such as Germany (11.01%), Italy (6.75%), France (5.35%), and Spain (4.35%), among others (Leather India, n.d). This regulation impacts the entire leather supply chain in India.

Source: Eurostat 2022

Source: Eurostat 2022

India is a major source of leather and leather accessories to the EU, and has garnered a partnership between the regions to create sustainable supply chains. EU-India partnered for a 42-month initiative, ‘Promoting Circularity in Tamil Nadu Leather Clusters for Solid Waste Management’, to focus on circularity through solid waste management and water efficiency practices (Solidaridad, 2022). Despite these efforts, in leather production regions like Tiruchirappalli, a depletion of water sources and destruction of forests and soil have continued to put people in hardships, in many cases resulting in a loss of soil as well (Ramalingam, 2016). Leather production in India has been progressing toward sustainability; a prime example of this move towards sustainability has been the Kanpur Leather Development Project, as implemented by the United Nations Industrial Development Organization (UNIDO), which introduced cleaner technologies to help tanneries reduce negative impacts on people’s health and the environment (Arthur,2025). Even so, there is a long way to go to meet globally recognized best standards.

ii. Cocoa & Coffee

India is an exporter of both cocoa and coffee to the European Union, with major destinations including Italy, Germany, and Belgium. Coffee is the primary export from India to the EU market, while cocoa exports are significantly lower in volume compared to coffee. In the first half of January 2025, India exported over 9,300 tonnes of coffee, with top buyers including Italy and Belgium; India is now the seventh-largest coffee producer globally, with exports reaching $1.29 billion in FY 2023-24 (PIB, 2025).

Sustainability practices have become more pertinent in coffee production in India. In May 2024, India’s High Range Coffee Curing is set to become the first farm verified by the Rainforest Alliance to ship EUDR-ready coffee beans to Europe. The Rainforest Alliance certification enables coffee (and cocoa) farmers to opt into these EUDR-aligned criteria (Rainforest Alliance, 2024). According to this certification, nearly 20% of the coffee grown in India is in line with these criteria (Rainforest Alliance, 2024).

Experts at the Rainforest Alliance found that although large coffee producers may be able to align with these criteria, smallholder coffee farmers will need support to ensure alignment, including traceability, deforestation risk mapping, local laws, and guidance on key environmental practices (Rainforest Alliance, 2024).

iii. Teak Wood, Eucalyptus, and Furniture

Even without specialized knowledge, it is evident that the deforestation regulation could bear significant consequences for the global wood industry, given its direct dependence on procurement from forests. Specific to wood products, EUDR prohibits the making of wood products that induce forest degradation after December 31, 2020. In 2023, India exported $868 million in wood products, making it the 38th largest exporter of wood products in the world (OEC,2024). Although India does export a large quantity of timber, including teak wood, to the EU, especially Germany, it does not dominate the market (Norman & Canby, 2020). This poses a more serious threat to this sector as, unlike for other supply chains like coffee, the EU may not be severely impacted by likely reductions in imports from India, in case the conditions specified by the EUDR are not met.

| Country | Export Destinations % |

| Germany | 20.7 |

| Netherlands | 18.4 |

| Italy | 8.01 |

| France | 7.19 |

| Spain | 6.93 |

| Norway | 2.56 |

| Denmark | 3.29 |

Wood export to EU countries from India

Source: OEC, Wood Products 2022-23

One of the primary challenges for the Indian exporters will be the compliance with the stringent traceability requirements of the EUDR. The manufacturers will now be required to provide geolocation coordinates of the harvest sides to prove wood and derived wood products are not sourced from deforested areas (GWMI, 2024). India has been facing severe challenges in preserving their forest covers, and the government has also invited criticism for setting up development projects in areas with rich biodiversity with weak implementation of the Compensatory Afforestation Fund Management and Planning Authority (CAMPA). Different states have different restrictions on the felling of wood/timber on private land, regulations under the Indian Forest Act, 1927, and orders in T.N. Godavarman vs. Union of India do streamline the process of legal registration (Forest Policy, 2014).

iv. Rubber

India plays a big role in the global rubber industry, currently ranking as the fifth-largest producer and significant exporter of rubber, particularly to the EU (TraceX, 2024). According to the United Nations COMTRADE database, the EU imported rubber worth approximately US $1.53 billion, which includes pneumatic tyres of rubber, and other articles of vulcanized rubber, tubes, pipes, etc. Due to its significant export, rubber cultivation in India has expanded significantly over the last few decades, especially in southern states like Kerala. Kerala accounts for 92% of the total rubber production and 84% of the area under rubber cultivation (TraceX, 2024). The deforestation caused by the growing demand for rubber has only recently been discovered, and the risk to climate-vulnerable states like Kerala poses a great threat in itself.

To ensure compliance with the EUDR, the Rubber Board is pushing for a centralized database of rubber plantations across India to establish a deforestation-free chain of rubber products (The Hindu, 2024). It has introduced an initiative to begin the geo-mapping of rubber plantations in Kerala beginning in March 2025 to enhance market access and align rubber production with the European Union Deforestation Regulation (The Hindu Bureau, 2025). Rubber products such as tyres are also facing challenges due to the regulations—since the rubber industry is characterized by a large number of small-scale farmers and intermediaries, traceability becomes an obstacle (DILIFY Team, n.d.). There is also a general lack of awareness and implementation systems to fulfill these geolocation requirements (DILIFY Team, n.d.).

EU’s Protectionist Measures and Compliance

The European approach to climate ambitions has exceedingly led to the implications for global supply chains through their regulations, such as the EUDR as well as the Carbon Border Adjustment Mechanism. This has also led to a ‘snowball effect’, where other countries, such as Canada, Australia, Indonesia, Vietnam, and Thailand, are also considering carbon pricing regimes (Clausing, 2023). Although it has been viewed as a ‘protectionist’ measure in some ways, the EUDR does not discriminate against import partners, unlike some policies introduced by developed countries to give a competitive edge to their domestic producers (as seen in the US’ Inflation Reduction Act). These measures have been introduced as part of the EU’s climate ambitions; however, countries such as the US have been opposed to the implementation of these measures to reduce market access. The implementation of the EUDR, which was originally scheduled for the end of 2024, has been delayed again. This delay has allowed more time to countries like India and businesses to align their products with the compliance requirements as per the EUDR. However, massive challenges remain.

Many Indian companies either do not have the infrastructure or do not have in place strict traceability and sustainability requirements by the EUDR. A lack of farm-to-export digital records, geolocation mapping, and deforestation-free proof could affect smaller businesses more harshly than bigger companies. The International Sustainability and Carbon Certification offers an EUDR certification basis and has been used by Indian companies to display compliance with other regulations, such as the Renewable Energy Directive (RED II). In many sectors, including steel, rubber, and coffee, India has taken into account their carbon footprint and aimed at creating a uniform system for certification to ensure minimal impact on trade with the EU. Despite that, it is also important to consider that although difficult, aligning with deforestation-free cultivation can hold many potential benefits, especially for local communities in India that have faced the disruption of their living environments.

Conclusion

The EU is at the frontier of driving climate adaptation across the world, with its forward-looking policies extending this practice to other countries across the world. However, this path of protection without fostering potential pathways for openness and partnerships with developing countries can come at the cost of disrupting global supply chains. The EU has been India’s trading partner in goods, with bilateral trade reaching $137.5 billion in the 2023-24 fiscal year (Reuters, 2025). Needless to say, the EUDR will have significant implications for their trade relations.

Even as a developing country balancing its own developmental needs, India has also shown its willingness and commitment to expanding its climate ambitions. However, assistance from the EU can help Indian businesses foster and align their manufacturing and export in these sectors with the regulations. By facilitating access to green financing mechanisms, such as blended finance models to help Indian companies, the EU can help companies transition to sustainable supply chains. Other initiatives, such as technical training in due diligence frameworks and knowledge and technology sharing initiatives, can support the adoption of the regulation, such as digital tracking tools and sustainability standards.

By collaborating on compliance strategies, capacity building, and policy alignment, India and the EU can turn the EUDR into an optimal driver of sustainable trade and promote investment rather than create a trade barrier.