Author: Ankita Tripathi

Editor: Riya Singh Rathore

Covid-19’s work-from-home culture has become the new normal, resulting in an increase in demand for electronics such as smartphones, laptops, and televisions, among other devices. However, this demand was unanticipated and affected the availability of microchips, one of the essential inputs used in almost every electronic item. Microchips, also known as silicon chips or integrated circuits [IC], are a set of electronic circuits on a small tile of silicon (ASML Foundation n.d.). Though smaller than a fingernail, microchips have revolutionised technology by increasing the efficacy, portability, and complexity of computing devices while being affordable.

However, as the pandemic raged on, bringing the society’s cogs to a halt, the effects have spilled over in the microchip industry, causing shortages in its supply. Since microchips are an essential component of almost every electrical device, the shortage results in production disruptions causing significant damage to industrial output. As India tries to restore the economy, a microchip shortage can pose a massive obstacle. This paper attempts to understand the implications of microchip shortfall on production and socio-economic development.

Semiconductor Industry after the Pandemic

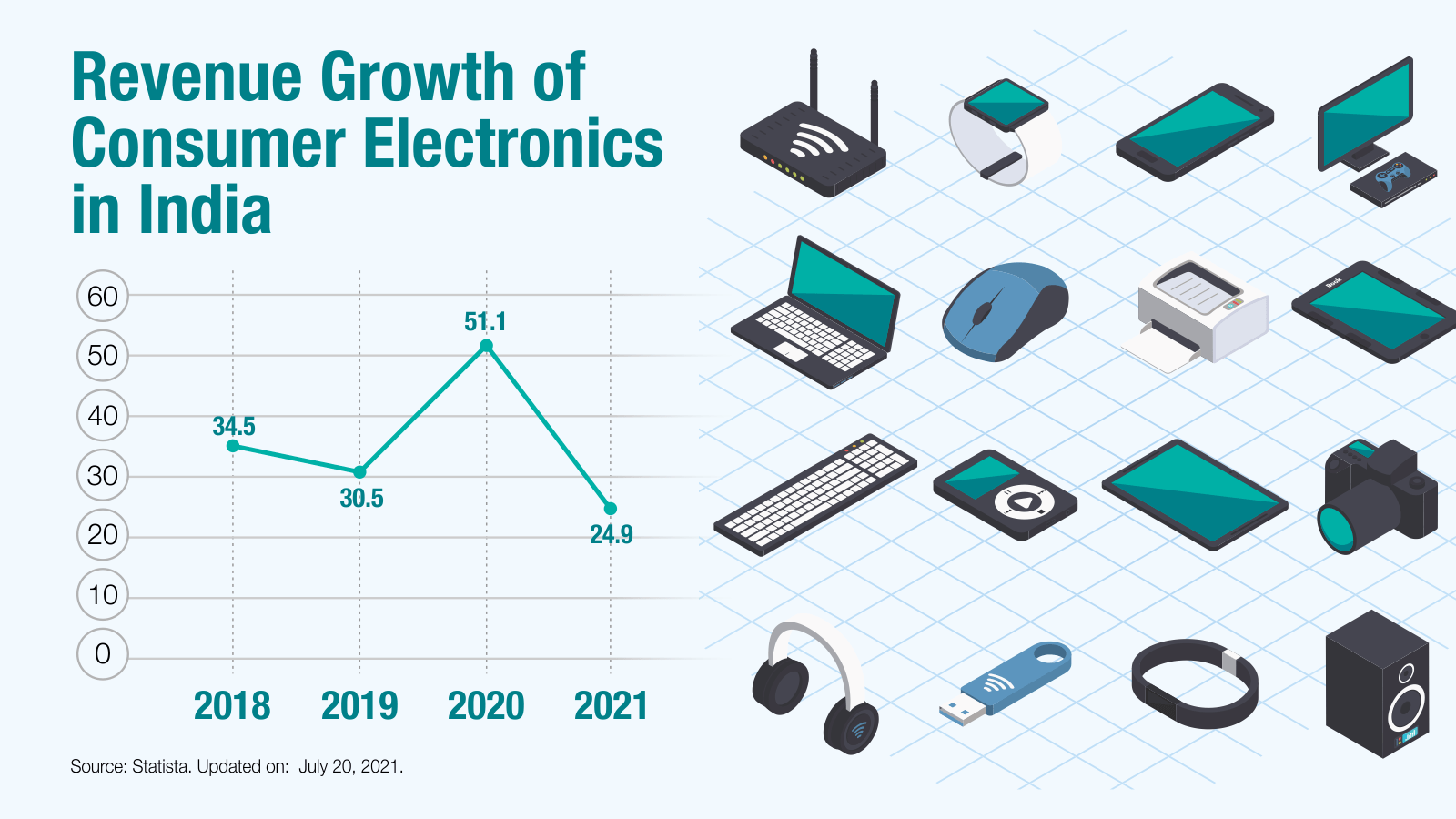

The microchip crunch happened due to reasons pertaining to both demand and supply. The demand for microchips has always been high. These silicon semiconductor chips are critical to every sector, from information technology to agriculture. However, Covid-19’s push towards the digital inflated the market for consumer electronics. Work-from-home became the need of the hour and overwhelmed the producers.

The figure shows the revenue growth of consumer electronics in India. The revenue growth surged after 2019.

The production was also affected due to lockdowns and workers being unable to work in countries like Japan, China, Taiwan, South Korea, and the US (Mukul 2021; May 2021). Taiwan, which is the leading producer in the foundry market or semiconductor production, accounts for more than 60% of the global foundry revenue and is capable of producing cutting-edge technology (Lee 2021). However, this also meant that production disruptions in Taiwan had a major impact on semiconductor and microchip availability. Other companies which use microchips also halted their manufacturing due to Covid, prompting less demand for semiconductors, thereby widening the gap between demand and supply (Hopkins 2021). As the market picked up, the excess demand led to a frenzy amongst semiconductor producers and suppliers, leading to the hoarding of microchips and worsening the supply in the market (Rivero 2021). The exceeding demand and dwindling supply thus crashed into the production of electronics, causing a microchip shortage.

As technology has become an integral part of everyday lives, any shortage in the semiconductor industry will have a profound effect.

Impact of Semiconductors shortage on the economy

Overall Consumption

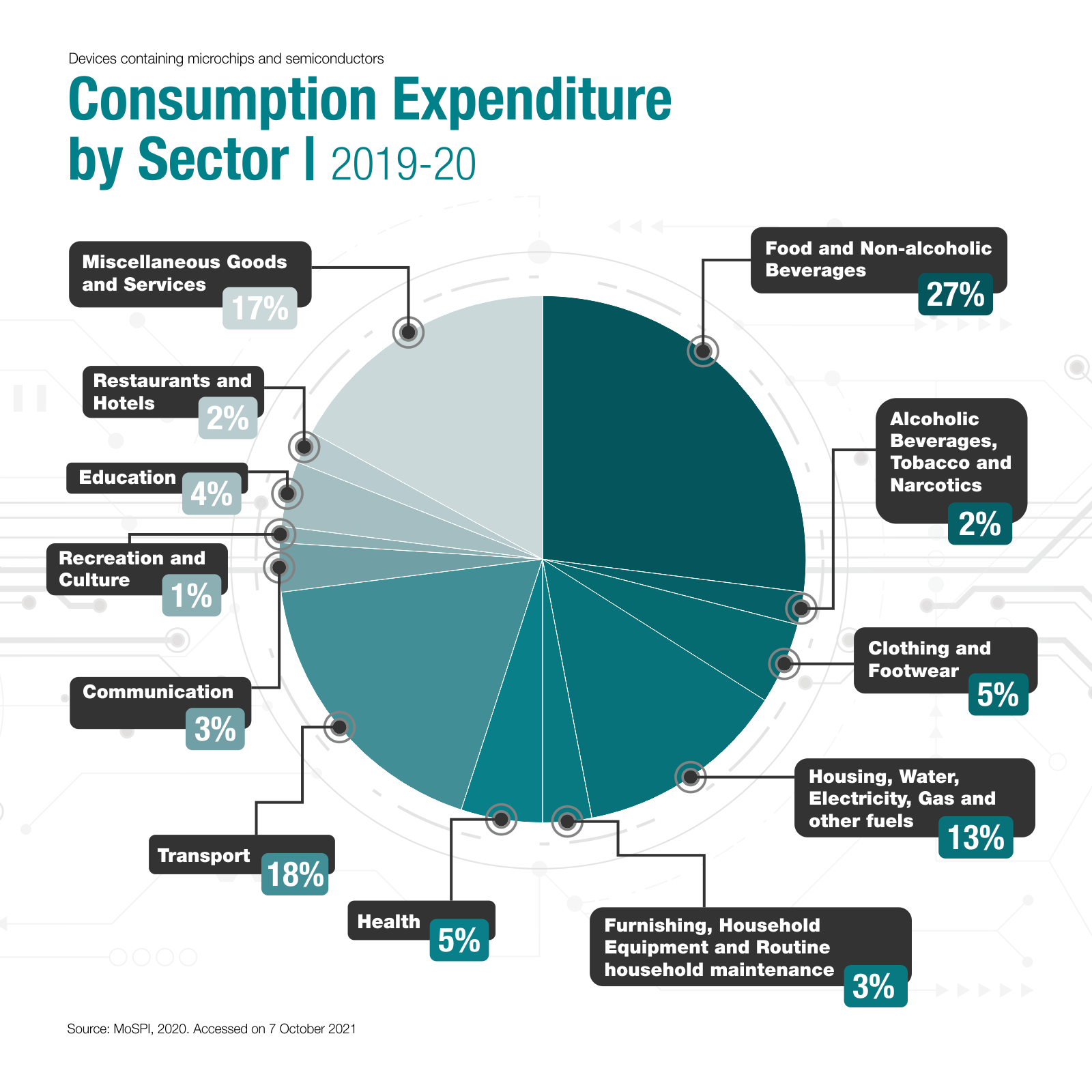

The Ministry of Statistics, Planning and Implementation [MoSPI] released the private consumption expenditure in 2019-20.

The major sectors which use devices containing microchips and semiconductors are education, recreation and culture, communication, transport, health, and certain household equipment. The shortage in microchips will affect these categories in expenditure, thus affecting almost 50% of an average Indian consumer’s spending. This will have an impact on two levels. Firstly, the shortage has led to a decrease in production and supply of goods, which will leave consumers without the products they want. Secondly, the supply shortage, as well as the increase in the price of semiconductors, will prompt producers everywhere to increase the price of their merchandise, thus affecting the demand (Jie et al., 2021). This could prove detrimental to a demand-deficient economy trying to get back on its feet.

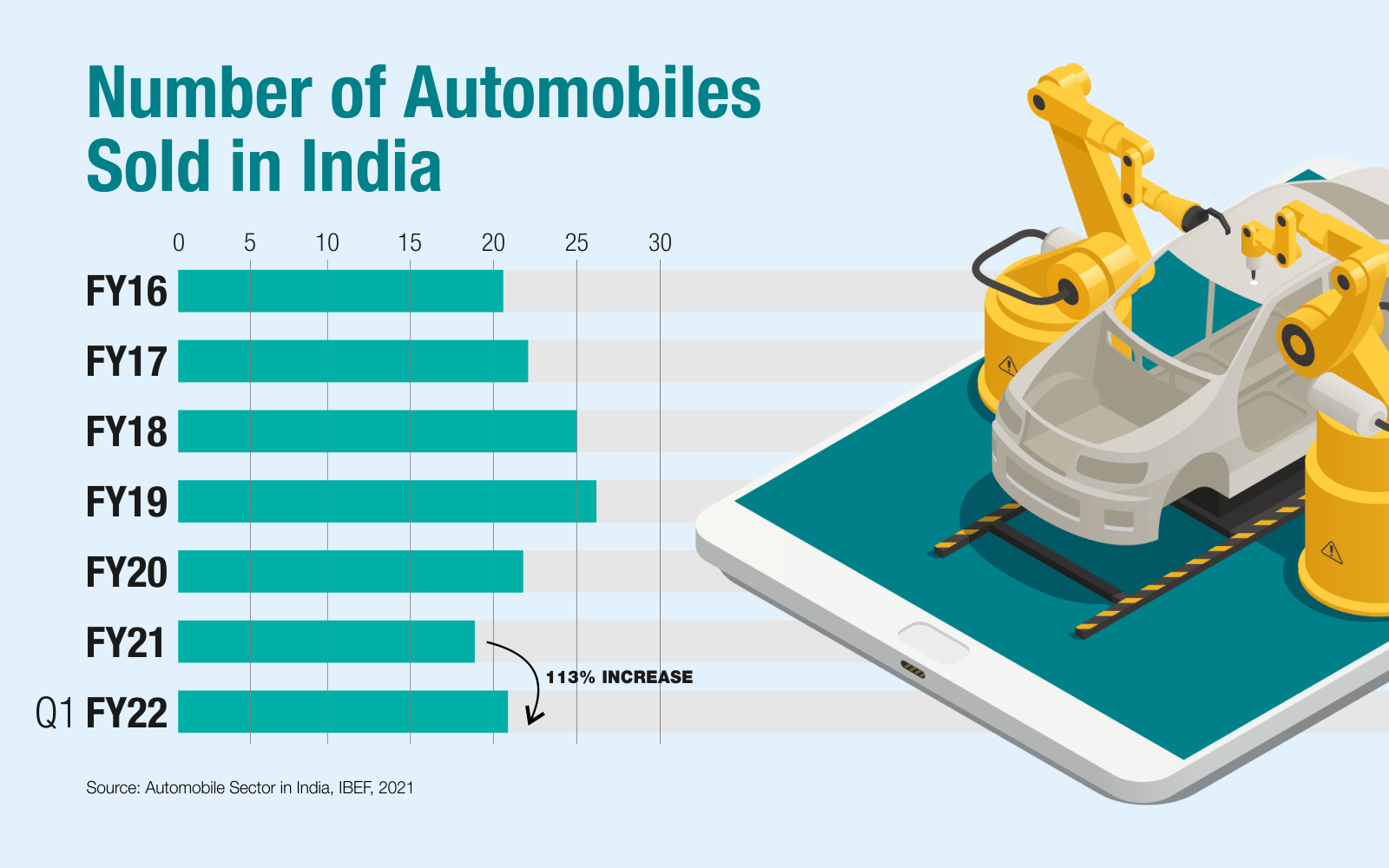

Automotive Electronics

Microchips and semiconductors are used in automobiles to enable sensors, provide a better driving experience, traffic or pedestrian recognition, GPS, entertainment, and communication services. The automobile market in India is ranked 4th globally and contributes 7.1% to the GDP (Invest India, 2021). The automobile sector in India reflects the health of the economy. The sector has deep forward and backward linkages with other economic sectors and contributes heavily to manufacturing and employment in the nation. Therefore, any change in this industry can have a deep impact on the overall economic development. India was facing a downturn in the automobile sector even before Covid-19, which only worsened during the pandemic.

However, the microchip shortage has caused disruptions in production across India. This has caused companies to revise their growth projections.

- A market of 290 billion USD (from 2019 to 2026) will be affected. More than 180 in 1000 people buying a vehicle will be affected due to the microchip issue (Jain et al, 2021).

- The increase in the price of semiconductors could increase the cost of producing a car by 5%.

- The cost of automotive electronics or electronics meant to be used for automobiles could rise to 10% by 2030.

- The market for electric vehicles (EV) in India will also be majorly impacted as these vehicles use semiconductors extensively (Smitt 2021). The EV market in India is forecasted to increase by a CAGR of 36% with the EV battery market to increase by 20% by 2026 (IBEF 2021a). The shortage will reduce the production of these vehicles, impeding India’s efforts to move towards green technology.

Mobile Phones

The pandemic highlighted the importance of possessing a mobile phone. With the lockdowns, even access to basic necessities and services was cut-off in the absence of phones. This spurred the digitisation of services in India and necessitated the availability of mobile phones, specifically, smartphones with access to the internet, in every household. However, the availability of inexpensive smartphones in the market will be impacted due to the microchip shortage, lasting for more than five years.

- India is expected to have 829 million smartphone users by 2022. (IBEF 2021c)

- The size of the global smartphone market was estimated at US$ 495 billion in FY 2018 and is expected to reach US$ 647 billion by FY 2025. (ICEA 2021a)

- Additional 505 million Smartphones will be produced from 2021 to 2025. (ICEA 2021b)

- Kaka et al. (2019) estimated that India will increase the number of internet users by about 40 % to between 750 million and 800 million and double the number of smartphones to between 650 million and 700 million by 2023.

- “The number of smartphone subscriptions was 810 million in 2020 and is expected to grow at a CAGR of 7 percent, reaching over 1.2 billion by 2026. Smartphone subscriptions accounted for 72 percent of total mobile subscriptions in 2020 and are projected to constitute over 98 percent in 2026, driven by rapid smartphone adoption in the country” (Ericsson 2021). Thus 390 million smartphone buyers will be affected by the microchip shortage.

The Appliance and consumer electronics industry is expected to double to Rs. 1.48 lakh crore (US$ 21.18 billion) by 2025 (IBEF 2021c).

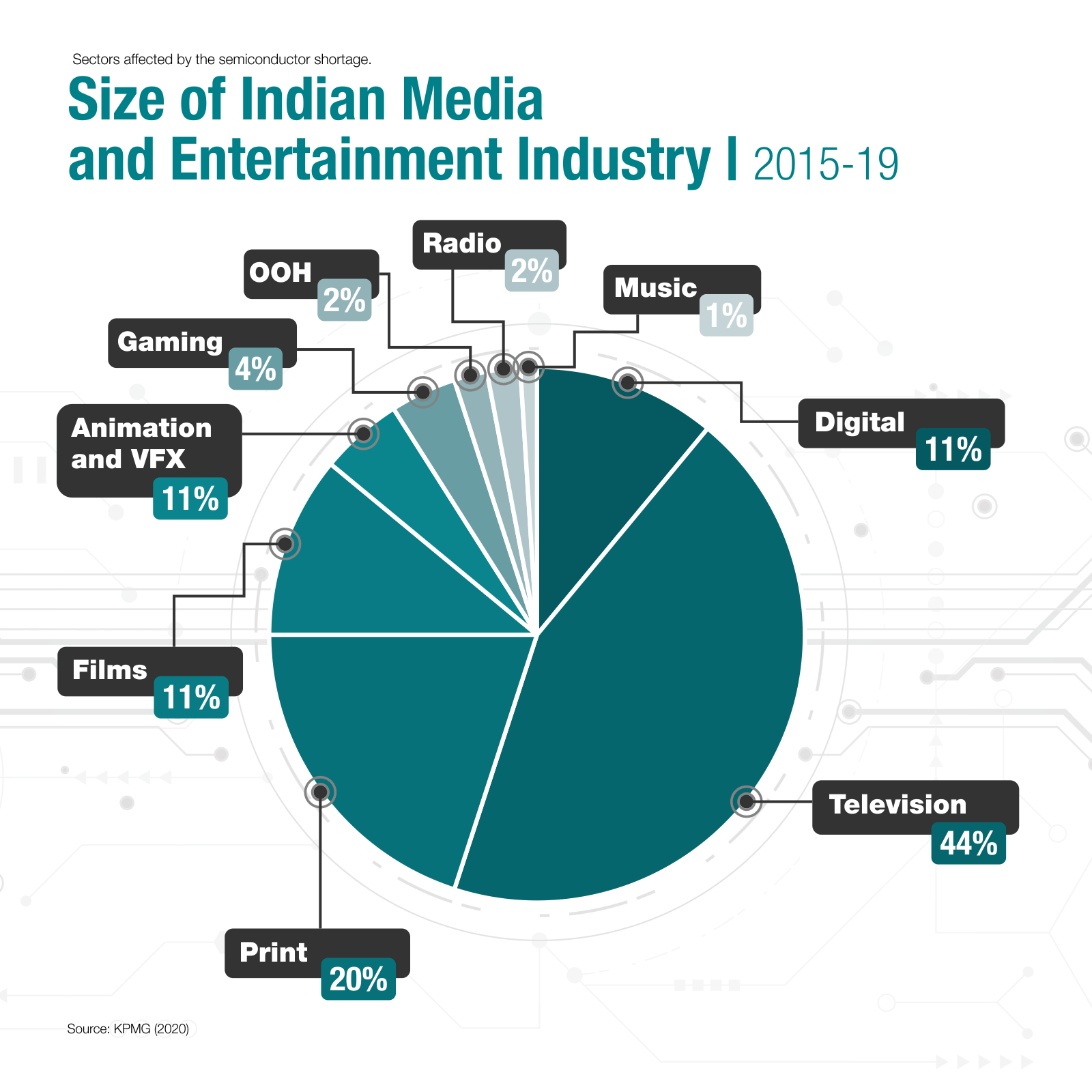

Media and Entertainment (M&E)

- The M&E sector is expected to recover 25% in 2021 to reach INR1.73 trillion (US$23.7 billion) and then to grow at a CAGR of 13.7% to reach INR2.23 trillion (US$30.6 billion) by 2023 (FICCI 2021). Access to media will become more difficult for consumers who are buying smartphones, laptops, TV, radio, music headsets etc. Production of digital content will also suffer as necessary equipment will become costlier.

- Sectors within entertainment will be affected by the semiconductor shortage.

- The gaming industry, which grew at a rate of 41.6% in 2019 from 2018, will also slow down in the next five years. Buyers are already experiencing a shortage as the gaming consoles get sold out minutes after being released (Arora 2021).

Impact on Trade

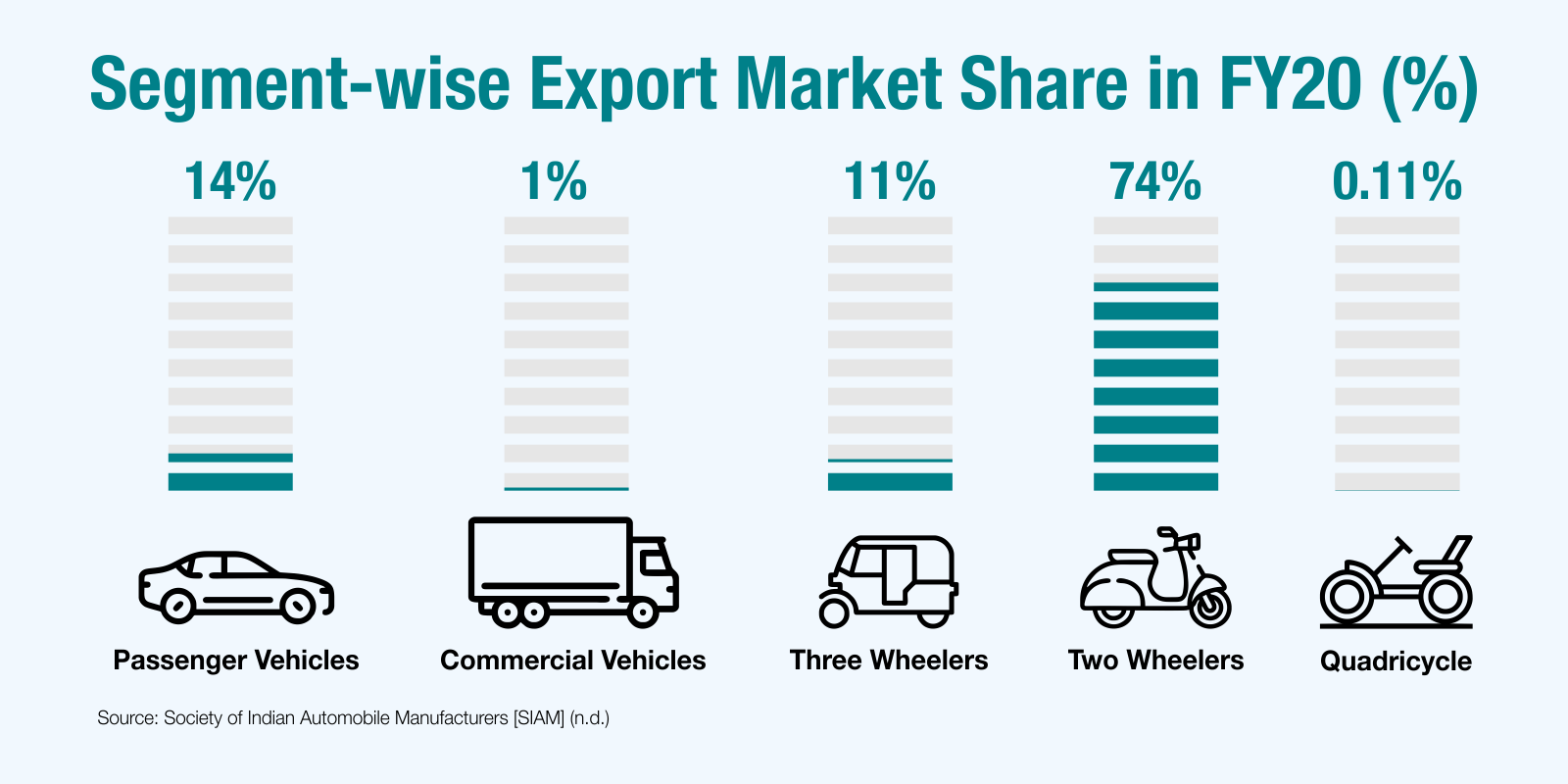

The automobile industry majorly produces and exports two-wheelers (Figure 3). These do not require as many microchips as higher-end cars with more digital features. Due to an increase in prices, the immediate effects will be felt by premium users, consisting of middle to upper-class populations. However, as the problem persists, car manufacturers will halt their productions and reduce their workers (Mohile 2021). This will increase the unemployment, investments, and demand in an already demand-deficient economy, hence slowing down the economic growth.

Opportunity

The production of semiconductors is a complex and expensive affair. It requires huge investments, cutting-edge technology, and sophisticated infrastructure (King, Leung, and Pogkaset 2021). It also faces cut-throat competition in terms of technology. India’s expertise lies in designing the microchip not manufacturing it. However, this shortage has highlighted its over-reliance on microchip imports which could have serious consequences for industrial production (Singh 2021). Therefore, there is a push to manufacture our semiconductors and compete with the global market. The semiconductor market in India is forecasted to reach $52.58 billion at a Compound Annual Growth Rate [CAGR] of 26.72% (IBEF 2021b). This market could be leveraged through domestic production of microchips under the Production Linked Incentive (PLI) scheme rolled by the government. The scheme proposes to increase manufacturing in India by providing financial incentives and attracting investments. The shortage along with the scheme can be the opportunity India is looking for to launch itself into microchip and semiconductor manufacturing.

References

- Lee, Yen Nee. (2021). “2 charts show how much the world depends on Taiwan for semiconductors”. CNBC, 15 March 2021. Accessed 2 November 2021, https://www.cnbc.com/2021/03/16/2-charts-show-how-much-the-world-depends-on-taiwan-for-semiconductors.html.

- Mukul, Pranav. (2021). “Explained: The semiconductor chips shortage, and how carmakers are coping”. The Indian Express, 25 May 2021. Accessed 27 September 2021, https://indianexpress.com/article/explained/explained-the-semiconductor-chips-shortage-and-how-carmakers-are-coping-7327321/.

- Hopkins, John. (2021). “Yes, the global microchip shortage is COVID’s fault. No, it won’t end any time soon”. GCN The Technology that Drives Government IT, 8 June 2021. Accessed 27 September 2021, https://gcn.com/articles/2021/06/08/covid-microchip-shortage.aspx.

- Jie, Yang, Yang Stephanie, and Kubota, Yoko. (2021). “World’s Largest Chip Maker to Raise Prices, Threatening Costlier Electronics”. Wall Street Journal, 26 August 2021. Accessed 2 November 2021, https://www.wsj.com/articles/worlds-largest-chip-maker-to-raise-prices-threatening-costlier-electronics-11629978308.

- Smitt, Brett. (2021). “How the Electric Car Industry has Impacted Semiconductor Demand”. AZ Materials, 23 April 2021. Accessed 2 November 2021, https://www.azom.com/article.aspx?ArticleID=20351.

- Indian Brand Equity Foundation [IBEF]. (2021a). “Automobile Industry in India”. Accessed 4 October 2021, https://www.ibef.org/industry/india-automobiles.aspx.

- King, Ian, Adrian Leung, and Demetrios Pogkas. (2021) “The Chip Shortage Keeps Getting Worse. Why Can’t We Just Make More?”. Bloomberg, 6 May 2021. Accessed 2 November 2021, https://www.bloomberg.com/graphics/2021-chip-production-why-hard-to-make-semiconductors/.

- Singh, Abhinav. (2021). “Why India is good at designing chips, but not at manufacturing them”. The Week, 15 July 2020. Accessed 2 November 2021, https://www.theweek.in/news/biz-tech/2020/07/15/why-india-is-good-at-designing-chips-but-not-at-manufacturing-them.html.

- Indian Brand Equity Foundation [IBEF]. (2021b). Semiconductor Industry in India. New Delhi, India: IBEF. Accessed 2 August 2021, https://www.ibef.org/industry/semiconductors.aspx.

- Indian Brand Equity Foundation [IBEF]. (2021c). Consumer Durables. New Delhi, India: IBEF.

- Jain, Karan, Raghav Sarin, Pilani Juhi, and Talwar Siddhant. (2021). Sector flash: Indian auto industry. New Delhi, India: Grant Thornton. Accessed 3 November 2021, https://www.grantthornton.in/globalassets/1.-member-firms/india/assets/pdfs/indian_auto_industry_sector_flash_april_2021.pdf.

- Indian Cellular and Electronics Association [ICEA]. (2021a). “Flat Panel Displays: Creation of a Display Industry In India”. New Delhi, India: ICEA.

- Indian Cellular and Electronics Association [ICEA]. (2021b). “Mobile manufacturing in a post COVID-19 world”. (2021b). Accessed 2 November 2021, https://icea.org.in/wp-content/uploads/2020/06/Mobile-manufacturing-in-a-post-COVID-19-world-1_compressed-1.pdf.

- Ericsson. (2021). Ericsson Mobility Report. Stockholm, Sweden: Ericsson. Accessed 3 November 2021, https://www.ericsson.com/assets/local/reports-papers/mobility-report/documents/2021/june-2021-ericsson-mobility-report.pdf.

- Federation of Indian Chambers of Commerce & Industry [FICCI]. (2021). Playing by new rules: India’s Media & Entertainment sector reboots in 2020. Kolkata: India, FICCI. Accessed 2 November 2021, https://assets.ey.com/content/dam/ey-sites/ey-com/en_in/topics/media-and-entertainment/2021/ey-india-media-and-entertainment-sector-reboots.pdf.

- Deloitte. (2019). Semiconductors – the Next Wave Opportunities and winning strategies for semiconductor companies April 2019. Beijing, China: Deloitte. Accessed 3 November 2021, https://www2.deloitte.com/content/dam/Deloitte/cn/Documents/technology-media-telecommunications/deloitte-cn-tmt-semiconductors-the-next-wave-en-190422.pdf.

- Arora, Akhil. (2021). “PS5, PS5 Digital Edition India Pre-Orders Restock Sold Out in Minutes”. Gadgets 360, 23 June 2021. Accessed 3 November 2021, https://gadgets.ndtv.com/games/news/ps5-india-restock-sold-out-flipkart-amazon-croma-reliance-digital-edition-playstation-5-2470359.

- Rivero, Nicolas. (2021). “The global semiconductor shortage can be explained by the bullwhip effect”. The Quartz, 8 May 2021. Accessed 3 November 2021, https://qz.com/2004569/the-global-chip-shortage-can-be-explained-by-the-bullwhip-effect/.

- ASML Foundation. (n.d.). “All about Chips; Basics of Microchips”. Accessed on 2 November 2021, https://www.asml.com/en/technology/all-about-microchips/microchip-basics.

- Ministry of Statistics and Programme Implementation [MOSPI]. (2019). “Private Final Consumption Expenditure at current and constant prices: 2011-2019”. New Delhi, India: MOSPI. Accessed on 26 September 2021, http://mospi.nic.in/publication/national-accounts-statistics-2021.

- Invest India. (2021). “Sectors in India”. Accessed 2 November 2021, https://www.investindia.gov.in/sectors.

- Kaka, Noshir, Anu Madgavkar, Alok Kshirsagar, Rajat Gupta, James Manyika, Kushe Bahl, Shishir Gupta. (2019). Digital India: Technology to transform a connected nation. New Delhi, India: McKinsey Global Institute. Accessed 2 November 2021, https://www.mckinsey.com/~/media/McKinsey/Business%20Functions/McKinsey%20Digital/Our%20Insights/Digital%20India%20Technology%20to%20transform%20a%20connected%20nation/MGI-Digital-India-Report-April-2019.pdf.

- Statista. (n.d.). “Consumer Electronics: Revenue”. Accessed 20 July 2021, https://www.statista.com/outlook/dmo/ecommerce/electronics-media/consumer-electronics/india#revenue.

- KPMG. (2020). KPMG in India’s Media and Entertainment report 2020. Mumbai, India: KPMG. Accessed 3 November 2021, KPMG in India’s Media and Entertainment report 2020 (assets.kpmg).

- Mohile, Shally S. (2021). “Semiconductor chip shortage may keep Maruti Suzuki’s margin in check”. Business Standard, 13 September 2021. Accessed 3 November 2021, https://www.business-standard.com/article/automobile/semiconductor-chip-shortage-may-keep-maruti-suzuki-s-margin-in-check-121091300014_1.html.

- Society of Indian Automobile Manufacturers [SIAM]. (n.d). “Automobile Export Trends”. Accessed 3 November 2021, https://www.siam.in/statistics.aspx?mpgid=8&pgidtrail=15