Author: Anusha Arif

Abstract

India is currently at a complex standpoint since, as the most populous country, it is continuously exploring new and alternative energy due to its growing energy needs. Yet, it is now also among the largest emitters in the world. Amidst India’s energy transition goals, the country is moving towards expanding its share of renewable energy, as well as exploring new technology, to support the growing energy needs of the country through its continued dependence on thermal power. To support its just transition ambition, the country requires innovative sources of climate financing. This paper expands on the idea of climate finance in the context of the country’s aspirations and addresses the gap in international climate finance mechanisms. It examines the necessity, scope, and challenges in access to climate finance. The study delves into the limitations and inadequacies of international climate finance mechanisms and India’s efforts on the national front to counter the problems by mobilising domestic financing architecture. It assesses the effectiveness of these measures in further attracting international investments. The paper concludes with a brief review of the present scenarios and a suggested roadmap for the country to meet its goals for energy transition and access.

i. The Idea of Climate Finance

The concept of just transitions evolves from the idea that countries need to achieve a balance between their development needs to provide access to clean and affordable energy and meet their commitments to contribute to the reduction of global GHGs emissions. Climate finance has been central to India’s energy transition needs. According to the UNFCCC, “Climate finance refers to local, national, or transnational financing, which may be drawn from public, private, and alternative sources of financing that seeks to support mitigation and adaptation actions that will address climate change” (UNFCCC, n.d.). Since the term is multifaceted, this definition does not constitute an all-encompassing understanding of climate finance. However, it touches upon what could comprise climate finance.

Climate finance is embedded in the principle of ‘common but differential responsibility’(CBDR) in international climate change policy. Through the years, the CBDR principle has taken on different meanings, but at its very core, it establishes that although all countries have a shared responsibility towards climate change. Yet these responsibilities differ due to the nature and magnitude of the harm caused by industrialised countries in their development process over the years. To formalise the adoption of this principle, it has been enshrined in the legal framework of the UNFCCC and recognised in international agreements such as the Kyoto Protocol and the Paris Agreement. In 2009 at the 15th Conference of Parties (COP15), industrialised countries pledged US$100 billion per year by 2020 to the Least Developed Countries (LDCs) and developing countries (EY, 2022). Considering the slow movement towards meeting the goal, the timeline for mobilising climate finance as promised by the developed countries was further extended to the year 2025 at COP21 (PIB, 2022a).

India is uniquely positioned in the discourse for climate finance as a developing country; it has been an active advocate for climate finance at international forums and yet, as a growing economy, it must also meet the challenges of financing through internal flow between the sectors. As a voice of action for the Global South at international forums, the country has advocated for the need for just transitions as well as pointed out the developed countries’ additional responsibility in providing support to the developing and least developed countries (LDCs). At COP26 to the UNFCCC held in Glasgow, United Kingdom, the country representative highlighted that the transfer of climate finance and low-cost climate technologies have become more important for the implementation of climate actions by developing countries (PIB, 2022a) amidst the net zero promises made by several countries including India. In line with the same, the first meeting of the G20 Sustainable Finance Working Group (SFWG) was held on 2-3 February 2023 in Guwahati, Assam, which set the table for the introduction of the 2023 SFWG work plan, which outlines three priority areas of work for the group in the current year:

- Mechanisms for mobilisation of timely and adequate resources for climate finance;

- Enabling finance for Sustainable Development Goals; and

- Capacity building of the ecosystem for financing toward sustainable development (SFWG, 2023)

The focus of the SFWG, established in the year 2016 as the Green Finance Study Group (renamed SFWG in 2018), is to meet the challenge of mobilising finance as a way of ensuring global growth and stability, further promoting the transitions towards greener, more resilient, and inclusive societies and economies.

The funding gap that has resulted from the economic slowdown in the aftermath of the COVID-19 pandemic has also pushed developing countries to explore alternative climate funding. It is also essential to consider alternate funding options to diversify sources in the midst of increased ambition. Some of the other sources for climate finance can be:

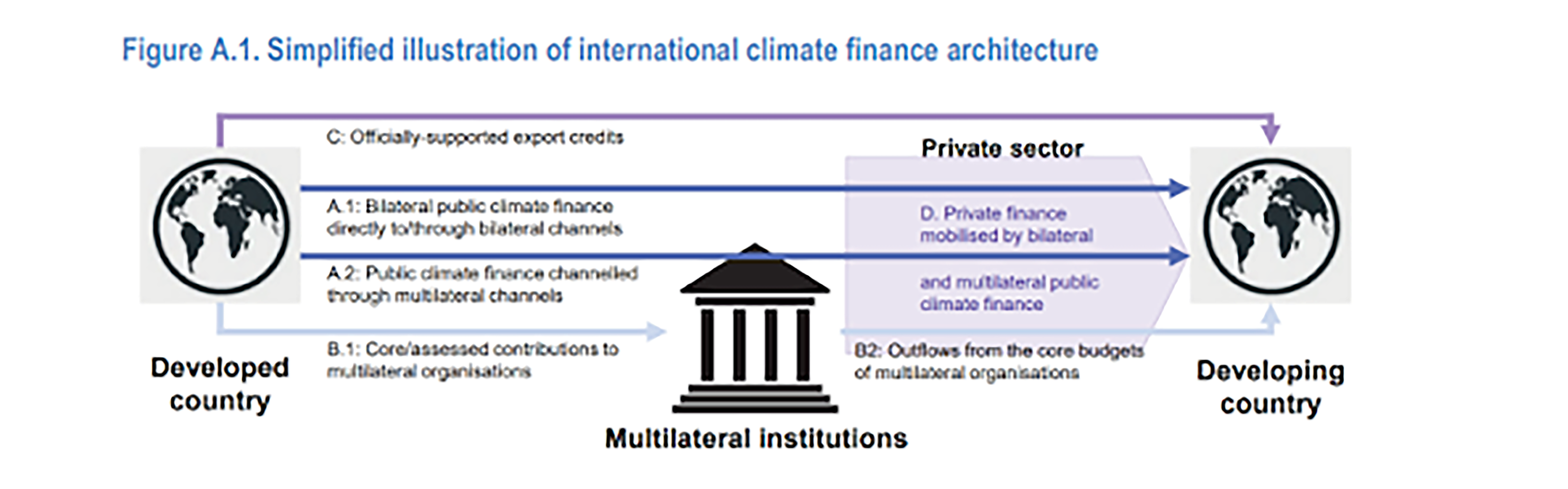

1. Multilateral development banks: Institutions like the World Bank, Asian Development Bank and African Development Bank provide climate financing through loans, grants and technical assistance to support climate mitigation initiatives and adapting projects.

2. Bilateral assistance: Developed countries can also provide climate finance directly to developing countries through bilateral agreements to support specific projects or projects towards a specific goal. This can be in the form of grants, concessional loans, technical assistance or even transfer of technology.

3. Domestic financing: Government concessions, loans or investments from private sectors can be a part of the domestic financing for climate mitigation. Businesses, investors and financial institutions also play a crucial role in advancing the development of renewable energy technologies, energy efficiency projects, and green infrastructure in the form of venture capital, private equity and impact investing.

4. Carbon markets: Emission trading systems and carbon offset projects allow companies and organisations to buy and sell carbon credits to meet their emissions reduction targets. International mechanisms such as the Kyoto Protocol (Article 17) and the Paris Agreement (Article 6) incorporate carbon markets. Many countries have also created domestic carbon markets, which can be integrated with other domestic or international carbon markets. India is also on the way to create its Carbon Credit Trading Scheme along with its current energy-saving-based market mechanism (PIB, 2023).

ii. International Mechanisms for Climate Finance

The umbrella framework in international policy for climate, the United Nations Framework Convention on Climate Change (UNFCCC), recognizes the responsibility of assistance from the countries that have more resources to those less endowed and more vulnerable (UNFCCC, n.d.) under its Article 11, it entrusts the operation of the financial mechanism to one or more existing international entities. The Global Environment Facility(GEF) and, thereafter, the Green Climate Fund (GCF) are entrusted as the operating of the Financial Mechanism (UNFCCC, n.d.).

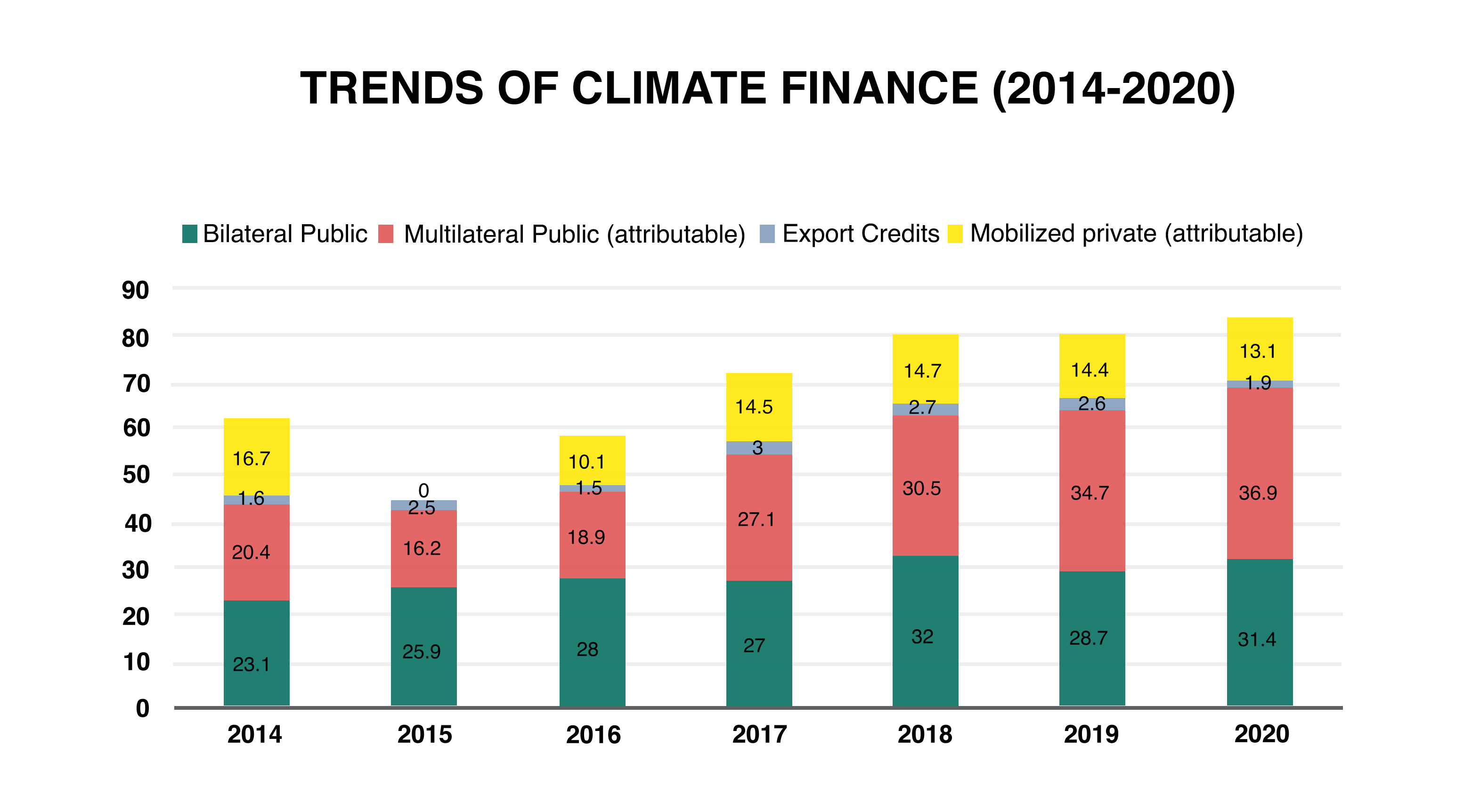

Figure 1 Source: Aggregate Trends of Climate Finance Provided and Mobilised by Developed Countries in 2013-2020 (OECD)

However, the industrialised countries have failed to fulfil their initial promise of providing US$100 billion per year in climate finance. While each individual country has not provided a reason behind this failure, it seems likely that the economic slump caused by the COVID-19 pandemic, geopolitics and conflicts could be the biggest attributable reasons for the failure to meet the promise. So far, the climate finance trends do not show the mobilisation of US$100 billion in any year between 2012 and 2020 even before the Covid-19 pandemic hit worldwide.

The industrialised countries mobilised 83.3 USD billion, the closest to the target year of 2020 (GCF, 2022), falling short by 16.7 percent. At COP26, the decision was made to set a new Collective Quantified Goal (NCQG) from the floor of US$ 100 billion per year (MoEFCC, 2022). Accounting for the whole period between the years 2013 to 2020 resulted in a gap of nearly US $381.6 billion or 48 per cent in bilateral and multilateral public climate finance attributable to developed countries (Achampong, 2022). Among the developed countries, the European Union, its member states and the European Investment Bank are together the highest contributors to public climate finance €23.04 billion in 2021 (European Commission, 2021). The EU has, with its forward-looking policies, shaped itself as a climate leader while other developed nations, such as the US and China, continue to fall short in their internal and external climate-facing endeavours. This is alarming simply because China and the United States are the world’s two biggest greenhouse gas emitters.

At the COP26, the expansion of finance pledges also took place to include specific pledges to help build resilience to climate change and the COP urged the developed nations to double their collective provision of adaptation finance from 2019 levels by 2025. It remains to be seen how these pledges will be met by the developed countries in the coming years. More recently, at COP28, the GCF received a boost to its second replenishment with new funding pledges from six countries, making the total pledges stand at a record USD 12.8 billion from 31 countries in total (UNFCCC, 2023).

Figure 2 Aggregate Trends of Climate Finance Provided and Mobilised by Developed Countries in 2013-2020 (OECD)

The parties to the Convention have created four additional special funds as well, which include the Special Climate Change Fund (SCCF), the Least Developed Countries Fund (LDCF), both managed by the GEF and the GCF under the Convention and the Adaptation Fund (AF) under the Kyoto Protocol. The GCF is the central source of dedicated multilateral funds and the main financial mechanism which is established to support developing countries in their mitigation and adaptation efforts.

The special funds dedicated to the Least Developed Countries and the Special Climate Change Fund are more focused on the need-based allocation of the funds. The LDCF is the only dedicated source of climate resilience funds for the 46 Least Developed Countries in the world, which does not include India. Major pledges to raise $413 million in new funding for the LDCF have been made during the COP26 Climate Summit. (UNFCCC, 2021) The purpose of the LDCF is to help countries implement their National Adaptation Programs of Action (NAPAs), which are country-driven strategies for addressing their most urgent adaptation needs. The NAPAs are different from the Nationally Determined Goals or the NDCs submitted by each country. The NAPAs are focused on resilience building to counter the impacts of climate change through medium-to long term planning. It is developed by countries through domestic planning and identification of their evolving adaptation needs.

The power imbalance within the international climate change policies and challenges that each country faces are identifiable between the two groups in stark differences; while the industrialised countries are focused on mitigating climate change, the other group of least developed countries struggle to adapt to climate urgencies that threaten the disruption of life. The least developed countries have higher climate and disaster risks as well and need enhanced adaptation measures. The LDCF has enabled financing for 365 projects with approximately $1.7 billion in grants, which is expected to benefit over 52 million people (GEF, n.d.)

In line with the enhanced climate finance promise as decided by the countries as a part of the Glasgow Climate Pact, the GEF-8 Programming Strategy on Adaptation to Climate Change for the LDCF and SCCF and Operational Improvements for the Period 2022-2026 was approved by the LDCF/SCCF Council (GEF, 2022) The Programming Strategy incorporates a GEF Small Grants Program 2.0 with an extended support of $150 million finance access to small grant resources in eligible countries, extend the SGP financing to all GEF agencies and develop innovative civil society organisations initiatives to support GEF-8 strategy implementation. It also aims to strengthen the role of micro, small and medium enterprises (GEF, 2022). Moreover, eight donor countries have also announced commitments to the Least Developed Countries Fund and Special Climate Change Fund at COP28. However, the discussions also highlighted that the current pledges still fall short of the trillion dollars required to timely counter the effects of climate change (UNFCCC, 2023).

iii. Need for Climate Finance in India

The idea of climate finance for India is unique to its own development needs as the country expands its share of renewable energy to meet its energy needs and expand focus on the electric vehicle market; it continues to rely heavily on thermal power. According to industry experts, India’s dependence on thermal power will not diminish at least till 2030. A notice issued by the Central Electricity Authority of India (CEA) on January 20, 2023, addressed that in the midst of the huge energy demand being witnessed in the country, the role of thermal power plants becomes crucial to meet the surplus demand. It pushed for the flexible operation of existing coal-fired power plants to ensure energy security while the country expands on its renewable energy mix (CEA, 2023).

Many new technologies are being discussed to support India in balancing its energy security needs and lowering its emission intensity. One of the major technological breakthroughs has been carbon capture, utilisation and storage (CCUS), which can enable the country to continue using its coal resources while minimising its emission intensity. Niti Aayog released a report on the CCUS Policy Framework and its Deployment Mechanism in India’, in November 2022 (PIB, 2022b). CCUS involves the capturing of CO2 emissions from fuel combustion or other industrial processes and its transport for underground storage in geological formations.

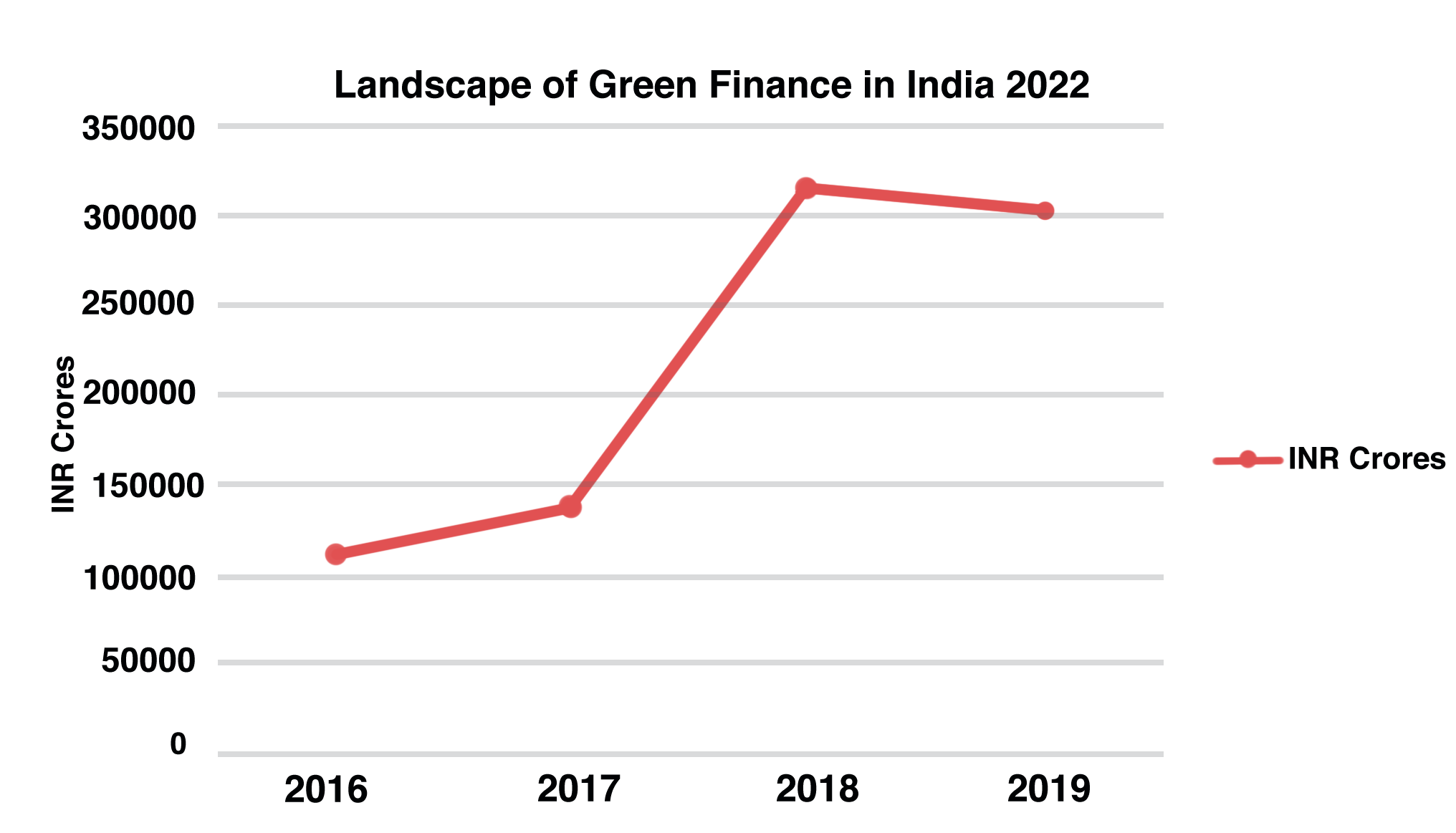

As of 2022, there were 29 commercial and pilot projects of CCUS in operation worldwide, which grew in number after the IPCC landmark report in 2018, which highlighted the need to reach net-zero global gas emissions by 2050 (Gordon, 2022) to meet the goals specified in the Paris Agreement. Yet, the concentration of these projects is in countries with higher aggregate wealth or perceived power, which includes the United States, Canada, China, Europe, Gulf Cooperation Council and other countries such as Australia, Brazil, Russia and New Zealand. This points to the fact that CCUS technologies are high-cost and would require a large investment for India to adopt. A committee named “Upstream for Carbon Capture, Utilisation and Storage (UFCC)” has been established by the Ministry of Oil, Petroleum and Natural Gas (MoPNG) to provide opportunities for industrial collaboration and knowledge sharing as well as develop a work plan for development and implementation of CCS/CCUS techniques in upstream exploration and production (E&P) in India (Tyagi, 2023). The ONGC has also identified a potential source and sink in Gujarat for the first large scale demonstration project. For the initial project developments in CCUS, there is a need for the creation of a fund pool through capital grants as well as tax credits. In its exploration for alternate clean fuels and meeting its Nationally Determined Contributions (NDCs) under the Paris Agreement, the country requires approximately INR 162.5 lakh crores (USD 2.5 trillion) from the year 2015 to 2030, which is estimated to be roughly INR 11 lakh crores (USD 170 billion) per year (Khanna et al., 2022).

Source: Landscape of Green Finance in India 2022; Climate Policy Initiative

The government can create a policy landscape for CCUS to enable foreign investment in the country for projects with a long-term goal of making India a CO2 storage hub. Even through the Clean Development Mechanism under the Kyoto Protocol, India was one of the top host countries for project investments by Annex party countries. These investments have resulted in some major developments in the transportation and other sectors of the country. For instance, the Delhi metro has introduced many sustainability initiatives to its operations, such as regenerative braking systems, with large investments from countries such as Japan.

The specific need in India’s climate financing ambitions is to focus on blended finance and a focus on trailblazing affordable technologies through a focus on research and development. The present start-up ecosystem is favourable for the country to push its technological advancements in a way that supports just transition. It is an impediment that sufficient focus and support be extended to the start-ups to counter problems specific to India and develop technologies that can be leveraged internationally.

iv. India’s Climate Financing Architecture

India finds itself in an inequitable situation as it balances its needs for economic growth and climate risks along with the challenges of providing clean and accessible energy to its fast-growing population. While it is not at the bottom of the pyramid in terms of development, it is among the most vulnerable to climate change, according to the XDI survey (Firstpost, 2023). It has remained one of the most active advocates of climate financing and, even at COP27, asserted the need of the developing countries for “substantive enhancement” in climate finance from the richer countries by 2024.

However, due to the limited outflow of climate finance from the international mechanisms, the country has been largely dependent on internal public and private climate finance generation and mobilisation. The country has shaped its climate finance architecture with several institutional and policy responses.

The first important step in the year 2008 was taken by the then Prime Minister, Dr Manmohan Singh, who appointed the PM’s Council on Climate Change, a body with 26 members from different ministries that were pertinent in the discussion of climate interventions and included the Ministry of Environment, Forest and Climate Change (MoEFCC), Ministry of Finance (MoF), Ministry of External Affairs (MoEA), Ministry of Agriculture (MoA), Ministry of Water Resources (MoWR), Department of Science and Technology (DST) and Ministry of New and Renewable (MoNRE). Further, the Economic Survey 2011-12 pushed for ‘Sustainable Development and Climate Change’ and also included a section on ‘Climate Change Finance’ (PIB, 2012; MoF, 2012). At the same time, the setting up of the Climate Change Finance Unit (CCFU) in 2011 was an important institutional step taken to streamline finance related to climate change.

At the national level, there are multiple channels of climate finance that have been set up by the CCFU, which include four funds, namely, (1) the National Clean Energy and Environment Fund (NCEEF), (2) the National Adaptation Fund (NAF), (3) Compensatory Afforestation Funds and (4) the National Disaster Response Fund (NDRF) (Singh, 2017). There are multiple flows of climate financing in India under the various mission objectives of the National Action Plan on Climate Change, which include both the public and private sector. The public sector climate financing includes all budgetary allocations, taxes and subsidies as provided by the central or state governments. The Union budget has made a 20% increase in its budgetary allocation in BE 22-23 to the Ministry of Environment, Forest and Climate Change from the BE 21-22.

| Actuals | Budget Estimate | Revised Estimate | Budget Estimate | |

| Total | 1967 | 2870 | 2520 | 3030 |

Source: PRS Legislative Research, Demand for Grant 2022-23 Analysis

The government has also extended support to the renewable energy sector by incentivising generation via direct subsidies, tax exemptions, cheap credits or reduced import duties (Jha, 2014, p 9). The various initiatives to enhance the renewable energy share in generation through government schemes such as the PM-KUSUM which aimed at adding solar capacity of 25.75 GW to the energy mix by 2022.

The private sector climate financing has been a major associate in multiplying flows. With liberalisation policies in 1991, the country began accelerating its private sector involvement in energy generation. With the international momentum towards net zero emissions, many large private sector companies in India have also begun to shift their focus to renewable energy. In July 2021, Tata Power announced that it would not build new coal-fired power plants and is aiming for carbon neutrality by 2050 (Garg, 2022). NTPC, Adani, JSW Energy, and Sembcorp Green Infra have also expanded their target renewable capacity. Some sectors, such as green hydrogen, are witnessing an inclination from both the government and private investors as this can drive the decarbonisation efforts for other sectors such as fertiliser and steel production. This can also reduce the import dependence on coking/non-coking coal and make India self-reliant (Yadav et al., 2021).

Most climate financing has been towards mitigation especially through renewable energy expansion. Yet, little focus has been given to the adaptation to climate and resilience to associated risks. The Reserve Bank of India(RBI) released a discussion paper and survey report to assess the preparedness of the Indian banks in terms of the climate-related risks. Out of the 34 commercial banks that had participated in the survey, most foreign banks had the most time-apt policies in place for climate risks. For instance, all foreign banks have aligned their climate-related financial disclosures to the Task Force on Climate-related Financial Disclosures (TCFD) framework. However, only some private sector banks and none of the public sector banks had done the same.

The banking sector must begin to incorporate both physical and transitional risks. The survey also highlighted the need for the banking sector in India to put in place a mechanism at top management level for overseeing and scaling up initiatives relating to climate risks and sustainability while also mobilising new capital to scale up green lending and investment in sustainable projects (RBI, 2022, p 6). The government has taken a big step towards strengthening sustainable finance in India; on February 1, 2022, the Union Minister for Finance and Corporate Affairs, Nirmala Sitharaman, announced the union government’s plan to issue sovereign green bonds to mobilise resources for green infrastructure (World Bank, 2023). Green bonds are debt securities or fixed income debt instruments in which an issuer (government, corporation or financial institution) borrows a large amount of money from investors for use in sustainable projects (Better Buildings, n.d.). The government has also issued the first tranche of its first sovereign green bond worth INR 80 billion in January 2023 and an additional INR 80 billion in the following month.

State Funds for Climate Action

The states in India vary in vulnerability and risk exposure to climate change. In 2009, the Government of India directed all state governments and Union Territories (UT) to prepare State Actions Plans on Climate Change (SAPCC). The SAPCC are driven by the state’s assessment of key issues and vulnerability assessments of their specific needs. Many states are thus increasing their allocation to climate action in the following years as a part of their SAPCC. Some of the states that have raised their climate ambition in recent years are:

1. Andhra Pradesh: The state which has a very high renewable energy potential has formulated a “Green Vision 2029’ to achieve sustainable development through energy efficiency and climate change mitigation. It aims at achieving 30% share in renewable energy, 50% in green cover for the state and 100% solid and liquid waste management infrastructure that is resilient to disasters, and reduce greenhouse gas emissions (CBGA, 2023). The state has expanded its installed capacity of power from renewable by 8% between 2019 to 2022. While there is still scope for the state to increase its expenditure on the renewable energy sector, it has spent much capital on secondary aspects such as transmission and distribution or rural electrification which does indirectly contribute to reduction in GHG emissions (CBGA, 2023).

2. Gujarat: The Finance Minister of Gujarat announced plans for setting up large-scale renewable energy projects (Usmani, 2022).The state is among the top in wind power capacity after Tamil Nadu and solar power capacity after Rajasthan and Karnataka. The state budget has set aside INR 60 crore for a group captive solar and wind energy park of 150 MW capacity. In its attempt to mitigate climate change, the state is one of the first in Asia to set up a sub-national government department of climate change. In 2018, the Climate Change Fund of Gujarat was operationalised with an initial fund of Rs 50 lakh (Climate Change Fund, 2018).

3. Madhya Pradesh: The state has set goals and actions towards climate action which include Green Housing, Climate Smart tourism in Gwalior, implementation of solar rooftop for all government buildings and public spaces. The Madhya Pradesh SAPCC has conducted vulnerability assessments to identify ten major sectors with a total required outlay estimated at INR 4,700 crores (Venkataramani et al., 2017). Major climate financing initiatives for the state are driven by the schemes under the government such as the Compensatory Afforestation Fund Management and Planning Authority (CAMPA), National Clean Energy and Environment Fund (NCEEF). The state has been sanctioned funding under the National Adaptation Fund on Climate Change for ‘Enhancing Adaptive Capacity to Climate-Change through Developing Climate-Smart Villages in Select Vulnerable Districts of Madhya Pradesh’ (Venkataramani et al., 2017).

v. Conclusion

The present architecture of climate financing in India reveals a significant gap between the needs of the developing country and the support provided by developed nations. This is one of the major reasons for India’s strong advocacy for climate financing at international forums as a voice for the Global South. Despite the continued failure on the part of the industrialised nations to fulfil their commitments, national agencies in India have stepped up their efforts to mobilise climate financing along with the private sector. They have recognised the urgency of addressing climate change and take proactive steps to allocate resources, establish innovative financing mechanisms and drive technological advancements.

The Indian government, through various initiatives and budgetary allocations, demonstrates its commitment to sustainable development. It has also shown promise for investment as a host country for projects under mechanisms such as CDM. Yet, the gap in climate financing can be a major hurdle in the country meeting its climate ambitions in the long run.

It is pertinent for the country to recognise the need to enhance its adaptation actions while at the same time finding solutions for mitigation challenges that could put the country in beneficial positions. This can be achieved through the government’s involvement in start-up companies through innovative financing mechanisms such as venture capital investment funds and regulatory support. By leveraging the human capital and the upcoming AI technologies, the country can move towards a more proactive method of extending its climate actions, especially in upcoming sectors such as electric vehicles, green hydrogen and CCUS. By employing these strategies, the government can provide the necessary financial incentives to motivate start-ups to drive green technology.

With some new policy initiatives taken by the government to allow carbon trading, it remains to be seen how much the government can drive climate finance from the private sector. India’s challenges of wealth accumulation must also be countered by putting in place green finance regulations on private sector companies and encouraging them to provide support for research, development and deployment of climate-friendly technologies.

It is crucial to acknowledge that the scale and urgency of climate change requires enhanced collaboration, increased financial flows and a fair and equitable global climate financing network. The absence of punitive measures in international policy has allowed the developed countries to take their responsibility lightly. However, the rapid advancements in climate risks must serve as a global reminder of not just the mitigation of climate change but the requirement of assistance to more vulnerable countries.

Notes

¹Least Developed Countries (LDCs) are countries recognized by the United Nations since 1921 which host about 40% of the world’s poor. There are 46 recognized LDCs. https://www.un.org/ohrlls/content/list-ldcs.

²The Task Force on Climate-related Financial Disclosures is a global organisation formed to develop a set of recommended climate-related disclosures that companies and financial institutions can use to better inform investors, shareholders and the public of their climate-related financial risks.

Bibliography

Achampong, L. (2022, September 07) Where do things stand on the global US$100 billion climate finance goal? European Network on Dept and Development. https://www.eurodad.org/where_do_things_stand_on_the_global_100_billion_climate_finance_goal#:~:text=In%20sum%2C%20the%20ongoing%20inability,provided%20between%202013%20and%202020.

Better Buildings. (n.d.). Green bonds. U.S Department of Energy. https://betterbuildingssolutioncenter.energy.gov/financing-navigator/option/green-bonds

Centre for Budget and Governance Accountability. (2022, October). Andhra Pradesh’s policy and budgetary priorities for transitioning towards green economic recovery. https://www.cbgaindia.org/wp-content/uploads/2023/01/green-economy-Andhra-Pradesh.pdf

Central Electricity Authority. (2023). Flexibilisation of coal fired power plant. Ministry of Power. Government of India. https://cea.nic.in/wp-content/uploads/notification/2023/03/Report_21022023-1.pdf

Climate Change Department. (2018). Establishment of Climate Change Fund of Gujarat. Government of Gujarat. https://ccd.gujarat.gov.in/Portal/Document/1_29_1_1_29_1_CCFG-GR.pdf

European Commission. (2021). Climate action, international climate finance https://climate.ec.europa.eu/eu-action/international-action-climate-change/international-climate-finance_en#:~:text=Capitalising%20the%20Green%20Climate%20Fund,-The%20Green%20Climate&text=Since%202014%2C%20it%20has%20gathered,half%20of%20this%3A%20%244.7%20billion.

FP Explainers. (2023, February 21). The countries most vulnerable to climate change: Where does India stand? Firstpost. https://www.firstpost.com/explainers/the-countries-most-vulnerable-to-climate-change-where-does-india-stand-12183932.html

G20. (2023, February 2-3). First G20 Sustainable Finance Working Group (SFWG) meeting co-chair’s summary. https://g20sfwg.org/wp-content/uploads/2023/05/1st-SFWG-meeting-co-chairs-Summary.pdf

Garg. V. (2022, April 09). View: Private sector driving renewable wave in India. Economic Times. https://economictimes.indiatimes.com/industry/renewables/view-private-sector-driving-renewable-energy-wave-in-india/articleshow/90724802.cms?from=mdr

Global Environment Facility (n.d.). Least developed countries fund. https://www.thegef.org/what-we-do/topics/least-developed-countries-fund-ldcf

Gordon, O. (2022, April 28) Carbon Capture: Where is it working?. Energy Monitor https://www.energymonitor.ai/tech/carbon-removal/carbon-capture-where-is-it-working/

Green Climate Fund. (2022, August). Eleventh report of the green climate fund to the conference of the parties to the United Nations Framework on Climate Change. UNFCCC. https://unfccc.int/sites/default/files/resource/GCF_Eleventh%20report%20of%20the%20GCF%20to%20the%20COP%20of%20the%20UNFCCC.pdf

Hussain, F. & Dill, H. (2023, June 12) India incorporates green bonds into its climate finance strategy. World Bank Blogs. https://blogs.worldbank.org/climatechange/india-incorporates-green-bonds-its-climate-finance-strategy

Jha, V. (2014, December) The coordination of climate finance in India. CPR https://cprindia.org/wp-content/uploads/2021/12/The-coordination-of-climate-finance-in-India.pdf

Khanna N., Purkayastha D., & Jain S. (2022, August 10). Landscape of green finance in India. Climate Policy Initiative. https://www.climatepolicyinitiative.org/publication/landscape-of-green-finance-in-india-2022/

Ministry of Environment, Forest and Climate Change. (2022, February 03). India’s Stand at COP-26. PIB. https://pib.gov.in/PressReleasePage.aspx?PRID=1795071#:~:text=The%20message%20conveyed%20by%20India,differentiated%20responsibilities%20and%20respective%20capabilities

Ministry of Environment, Forest and Climate Change (2022, July 28). India has taken lead to raise the issue of climate finance at international forums. PIB. https://pib.gov.in/PressReleasePage.aspx?PRID=1845822

Ministry of Power. (2023, May 11). Indian Carbon Market (ICM) to spur mobilization of investments for transition to low-carbon pathways:Shri Abhay Bakre. PIB. https://pib.gov.in/PressReleasePage.aspx?PRID=1923458

PIB (2012). First time a chapter on climate change to be included in the forthcoming economic survey of India. New Delhi. http://pib.nic.in/newsite/erelease.aspx?relid=79579.

PIB. (2022b, November 29). Niti Aayog releases study report on ‘Carbon Capture, Utilisation, and Storage (CCUS) Policy Framework and its Deployment Mechanism in India. NITI Aayog. https://pib.gov.in/PressReleasePage.aspx?PRID=1879865

Receive Bank of India. (2022). Report of the survey on climate risk and sustainable finance. https://rbidocs.rbi.org.in/rdocs/PublicationReport/Pdfs/SURVEYCLIMATERISK3DB3ABB0E087445797BF79BC940AEFC6.PDF

Saha, S. (2022, November 22). Is climate finance a pipe dream or a reality? EY. https://www.ey.com/en_in/climate-change-sustainability-services/is-climate-finance-a-pipe-dream-or-a-reality

Singh, D. (2017, September). Climate finance architecture in India. Centre for Budget and Governance Accountability. https://www.cbgaindia.org/wp-content/uploads/2017/12/Climate-Finance-Architecture-in-India-1.pdf

Tyagi, H. (2023, January 02). E-fuels and carbon capture: Possibilities and opportunities in the Indian landscape. International Journal of Projects, Infrastructure and Energy Law. https://ijpiel.com/index.php/2023/01/02/e-fuels-and-carbon-capture-possibilities-and-opportunities-in-the-indian-landscape/

UNFCCC (2021, November 9). US $413 million pledged for the most vulnerable countries at COP26. https://unfccc.int/news/us-413-million-pledged-for-most-vulnerable-countries-at-cop26

UNFCCC (n.d.). Climate Finance in the negotiations. https://unfccc.int/topics/climate-finance/the-big-picture/climate-finance-in-the-negotiations

UNFCCC (n.d.). Introduction to Climate Finance. https://unfccc.int/topics/introduction-to-climate-finance#:~:text=What%20is%20climate%20finance%3F,that%20will%20address%20climate%20change

UNFCCC (2023, December 13). COP28 agreement signals “Beginning of the End” of the fossil fuel era. UN Climate Press Release. https://unfccc.int/news/cop28-agreement-signals-beginning-of-the-end-of-the-fossil-fuel-era#:~:text=Increasing%20climate%20finance&text=The%20Green%20Climate%20Fund%20

Usmani, A. (2022, March 27). How Prepared are India’s State Budgets for Climate Action. BQ Prime. https://www.bqprime.com/business/how-prepared-are-indias-state-budgets-for-climate-action

Venkataramani, V. Shivaranjani V., & Sundaresan, R.(2017) Financing State Climate Actions. Shakti Foundation. https://shaktifoundation.in/wp-content/uploads/2017/11/Financing-State-Climate-Actions.pdf

Working Document: GEF Secretariat (2022). GEF-8 programming strategy on adaptation to climate change for the LDCF and SCCF and operational improvements for the period 2022-2026 (GEF/LDCF.SCCF.32/04/Rev.01), GEF. https://www.thegef.org/council-meeting-documents/gef-ldcf-sccf-32-04-rev-01

Yadav D., Guhan A., & Biswas T. (2021, September 19). Green Steel moving to steelmaking using hydrogen and renewable energy. CEEW https://www.ceew.in/publications/decarbonising-steel-production-using-hydrogen-and-renewable-energy-in-india#:~:text=Green%20hydrogen%2Dbased%20steelmaking%20can,for%20mid%2Dcentury%20and%20beyond.