Introduction

The global beauty industry, per a McKinsey analysis, reached USD 446 billion retail sales in 2023, outperforming other consumer sectors. This marked a 10% growth from 2022, majorly driven by price increases rather than volume increases; the global volume rose only 2%. The market, growing at a Compound Annual Growth Rate (CAGR) of around 6%, is appraised to reach approximately USD 590 billion by 2028. In the analysis, India stood out with a growth rate of 10%, which comprised volume growth of 4% and price growth of 6%. The data showed that Indian consumers, regardless of income levels, were willing to increase their spending on beauty products in 2023 and 2024. The Nykaa Beauty Trends Report 2024 also makes the estimation that the Indian Beauty and Personal Care (BPC) market will reach USD 34 billion by 2028, with a CAGR of 10-11%. It extrapolates the demand of skincare to be the highest, with a CAGR of 13%, followed by makeup (12%), hair care (11%) and fragrance (10%).

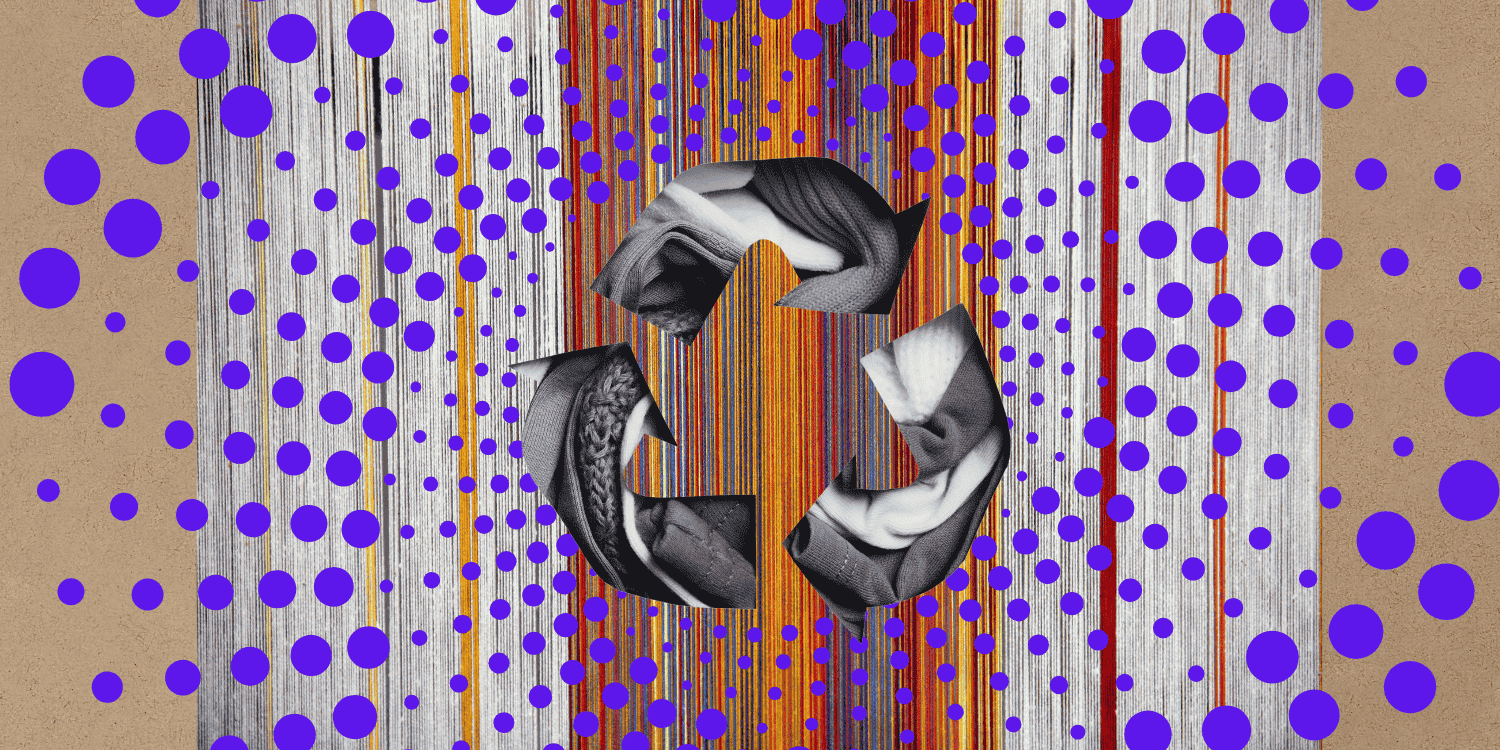

The BPC industry is not without faults, and its unsustainability leads the charge. The industry is estimated to produce at least 120 billion pieces of packaging each year. The British Beauty Council articulates that 95% of cosmetic packaging is dumped. Additionally, merely 14% of the packaging reaches a recycling facility, with only 9% being recycled and the rest ending up in landfills. A big chunk of this waste is single use plastic packaging which can take up to 450 years to break down. The International Union for Conservation of Nature (IUCN) hints that over 460 million metric tons of plastic is generated annually for a variety of purposes. According to the United Nations Environment Programme, it is estimated that 19-23 million tonnes of plastic waste enters our oceans every year. This waste is expected to increase by 2040. Currently, the estimated amount of plastic in the ocean is 75-199 million tonnes. These macroplastics, owing to solar radiation, wind, and ocean currents, degrade into microplastic particles (less than 5 mm) and nanoplastic particles (smaller than 100 nm). Such nanoplastic particles are able to penetrate cell membranes endangering the lives of marine species.

Acknowledging the need for sustainable and natural products, a ‘clean beauty’ trend has emerged among gen Z and millennials since the COVID-19 pandemic. The National Institute of Fashion Technology surveyed 165 millennials during the pandemic. The study found a shift in customer preferences towards mindful beauty, emphasising their preference for organic, cruelty-free, and non-toxic products. It identified a growing interest in inclusive, gender-neutral beauty, the trend of “skinmalism” with minimal skincare routines, and the influence of social media in promoting no-makeup looks. Furthermore, the study pointed out a greater reliance on DIY beauty remedies and a transition from salon visits to home beauty care driven by safety concerns.

This article delves into the complexities behind the clean beauty trend. It highlights the trend’s lack of regulation, susceptibility to greenwashing, and environmental drawbacks. It also brings forth potential solutions for developing circularity in the BPC industry, via the use of agri-tech. In closure, the article advocates for improved government regulation in India to define clean beauty, enforce sustainability practices and facilitate circularity in industry.

The Problem with the Clean Beauty Trend

While the trend is notable in bringing about a revolution in the BPC industry, it is not free from criticisms. With no regulatory body or common consensus, the term ‘clean beauty’ has no fixed definition and is shrouded with ambiguity. In an interview with Vogue India, co-founders of Asa beauty, Asha and Sukriti Jindal Khaitan, disclose that the definition of clean beauty varies by brands. For some, clean beauty is using no synthetic ingredients, while to others, it is using formulations that are natural and ethical. The absence of regulations and global definition allow brands to market products as ‘clean’ based on their own definitions.

With the advancement of clean beauty, there exists the fear of being greenwashed. Greenwashing refers to a marketing gimmick, wherein consumer demand for environment-friendly products is exploited via terms like ‘no nasties’, ‘clean beauty’, or ‘organic’, and through minimalistic and green or brown coloured packaging designs. Brands often put on a façade of being clean and green, yet many fail to back it up with real sustainable practices.

Yet another problem prevails with the packaging. Many cosmetic packaging materials are made of polyethylene, a synthetic material that is chemically and structurally resistant to chemicals. The use of polyethylene as packaging material has a large environmental impact, since the material that is discarded is released into both terrestrial and marine environments and over time releases microplastics and other toxic materials into the soil and marine ecologies.

Wastewater from the cosmetic industry has extreme pH levels. Imbalances, caused from this runoff, disrupt the cellular functions of aquatic life, damage enzymes and reproductive capabilities. Even minimal exposure of these substances could stress or decimate sensitive species. Furthermore, the wastewater also has elevated levels of chemical oxygen demand, which suffocates aquatic life and reduces biodiversity. The use of synthetic microbeads in BPC products, such as soaps, toothpaste and facial scrubs, such as soaps, toothpaste, and facial scrubs, makes up a major component of the microplastic problem. The microbeads in question are usually fashioned from polyethylene material. There is a significant likelihood of them being transported to wastewater treatment plants where they may escape into oxidation ponds or sewage sludges.

Innovations and Technology

According to the UNEP Food Waste Index Report 2024, 1.052 billion tonnes of food are wasted year after year, which accounts for approximately one third of the food produced for consumption. Food Loss and Waste (FLW) occurs at several stages in the supply chain, including primary production, processing, retail, food service. It even takes place at household level. A decrease in the quantity or quality of food prior to the stage at which a consumer can utilise the food is referred to as food loss. Losses which occur during harvesting, storage, processing and distribution in the supply chain are the foremost contributors of food loss.

Peels, seeds, shells, pomace, and leaves represent some of the by-products from the agri-food industry. They are valuable as they contain bioactive compounds (phenols, peptides, carotenoids, anthocyanins and fatty acids), fibers, enzymes, and antioxidants that can be used for cosmetic purposes. These untreated by-products are likely to bring about grave environmental degradation, since their breakdown in landfills results in methane and carbon dioxide production, which contributes to climate change and air pollution.

Nanotechnology is bringing forward a revolution in the beauty world by creating sustainable and high performance products. This technology amplifies the effectiveness and bioavailability of FLW based products through molecular modulation. Bioactive ingredients prove to be more efficacious, allowing for usage of reduced quantities and subdued reliance on synthetic additives. Incorporating bioactive compounds in BPC products could aid in waste reduction and circular economy advancement. Natural nanoparticles, produced through biological processes, are cost effective, environmentally friendly, and have low toxicity, all the while offering various beauty benefits, including antioxidants, anti-aging benefits, hydration, skin whitening, and UV protection. Nanotechnology in the processing of agricultural by-products (in the form of bioplastics) to make BPC products complies with global sustainability objectives, including the United Nations’ 2030 Agenda for Sustainable Development, but a precautionary approach is required because not all nanoparticles are safe and some may be toxic and can irritate skin. It is therefore essential to use only safe nanoparticles (in the form of liposomes, nanocapsules and dendrimers) in BPC products, as nanotechnology must be sufficiently sustainable.

Fermentation is another way to utilise agri by-products in BPC that could boost the efficacy and sustainability of cosmetic ingredients. Fermentation decomposes complex compounds into simpler, more bioavailable forms. This enhances the skin’s capacity to absorb and harness these ingredients feasibly. The process enables the creation of bioferments, biosurfactants, natural pigments, aromas, and collagen peptides, which are safer and more compatible with the skin than synthetic alternatives. Not only does fermentation maximise the quality of ingredients, but it also reinforces the concept of circular economy by revamping FLW into salutary ingredients for BPC products. Fusion of fermentation technologies into the cosmetics industry could aid radically shrink its ecological footprint, reducing reliance on petrochemical substances and curtailing waste generation.

Sustainable packaging could enhance circularity within the BPC sector, especially as a potential substitute for polyethylene. Sustainable packaging often uses compostable crops, such as corn or sugarcane, as well as cellulose-based films which are derived from wood pulp and possess high clarity as well as biodegradability. Other notable advancements include mycelium-based packaging, which is produced by growing the root-like structures of fungi on agricultural waste. Once molded and dried, it takes the form of lightweight and compostable packaging. Moreover, biodegradable packaging from red and brown seaweed is particularly advantageous because it can be cast into edible films and is suitable for marine composting, enabling single use disposability. These alternatives not only curb the environmental impact of the packaging industry, but also support circular economy principles by downscaling fossil fuel inputs and increasing waste valorisation.

Recommendations

The Government of India plays an instrumental role in ensuring the safety and sustainability of cosmetics through organisations like Bureau of Indian Standards (BIS) and Central Drugs Standard Control Organisation (CDSCO). Under Schedule S of the Drugs and Cosmetics Rules 1945, BIS sets the standards for products. Rule 134 restricts the use of unapproved dyes, colours and pigments and also sets limits for heavy metals. CDSCO ensures that products comply with quality and safety norms and keeps out harmful ingredients. Also, the government has laid down conclusive guidelines for labelling and packaging which requires companies to clearly mention the ingredient list (in descending order of percentage of ingredient used), batch number, manufacturing details and expiry date.

However, these measures are not adequate. Fostering circularity in the BPC industry ought to be the epicenter of the government’s policy and initiatives. The BPC industry in India has been long overlooked in terms of a concrete regulatory system around circularity. Some conscious brands are already incorporating circularity through refillable containers, responsible procurement, and low waste production. However, such initiatives are piecemeal and insufficient without compulsory policies. It is critical for the government to take action towards circularity in this industry.

Substantive change in the beauty industry requires active attention from the government, in the form of Research and Development (R&D) on the development of sustainable materials and bio-based cosmetics. Such R&D could abet in reducing dependence on fossil fuel-based and ecologically detrimental materials, while fostering scalable, environment-friendly substitutes for general use.

Agri-tech has immense potential for circularity by allowing waste-to-resource models. There exists a possibility to metamorphose agri by-products into valuable cosmetic ingredients using agri-tech. Fostering cross-sector collaboration between the agriculture and cosmetics sectors could result in a reliable, low-impact supply chain for natural raw materials, while adding value to agricultural waste and reducing pressure on landfills.

There is also a considerable need to formulate a distinct and consistent definition of ‘clean beauty’ that is relevant to the Indian market. Without a uniform, government-endorsed framework, brands tend to participate in greenwashing. Establishing a clear definition supported by criteria such as ingredient safety, ethical sourcing, environmental impact, and recyclability would allow for consistent regulation, strengthen consumer trust, and encourage responsible innovation.

In tandem, the establishment of Extended Producer Responsibility (EPR) for beauty and personal care products is vital. EPR policies mandating brands to manage the end-of-life disposal, recycling, or reuse of their packaging and product waste, would hold producers accountable, and incentivise design for recyclability, minimal packaging, and closed-loop systems.

There stands an immediate need to impose a ban on the use of microbeads in BPC products. Microbeads are miniscule pollutants, permeating our water, threatening marine species, and finding their way into the food chain. Banning them will enable India to work towards meeting globally accepted standards of sustainability and proving its commitment towards United Nations’ Sustainable Development Goals.

Conclusion

With the accelerated growth of India’s BPC industry, there is a concern regarding the sustainability of the cosmetic products. From toxic cosmetic runoff to plastic packaging and microbeads, the industry is a huge contributor to marine pollution, natural resource depletion and ecological damage.

In this context, agri-tech is a potential solution. India is increasingly building a robust agri-tech system, which can be leveraged in BPC product production. Fermentation, nanotechnology and biodegradable packaging materials help the industry move towards a more circular and sustainable model that minimises its ecological footprint.

Policy support is needed to accelerate this transition. Governments must invest in R&D, set clear standards of clean beauty, and invoke EPR guidelines to control product supply chains. Strengthening national packaging and labeling policies and banning harmful additives as microbeads will empower consumers and hold brands accountable. Industry, government and citizens must come together to build a responsible and robust beauty ecosystem.