Background

India’s position as the world’s third-largest primary energy consumer, highlighted in the India Energy Outlook 2021 by the International Energy Agency (IEA), emphasises its growing energy needs (International Energy Agency, 2021). However, these needs are primarily met through substantial oil imports, posing challenges regarding energy security, environmental concerns, and substantial foreign currency outflows (ibid.).

The World Energy Outlook 2021 by the IEA predicts a notable surge in India’s global energy consumption share by 2050. Currently standing at 6.1%, this share is anticipated to climb to approximately 9.8% (Ministry of Petroleum & Natural Gas, 2022). Strategic initiatives have been recommended to address this trajectory. These encompass encouraging investments in Exploration & Production to boost domestic oil and gas production, aiming to reduce reliance on imports. Additionally, strategies involve transitioning to a gas-based economy, refining refinery processes for better efficiency, and emphasising energy productivity as pivotal elements.

Within these strategies, domestically produced ethanol emerges as a potential solution. Blending ethanol with conventional fossil fuels offers a way to diminish dependency on oil imports while tackling environmental concerns related to fossil fuel usage.

India’s Ethanol Journey

India’s journey into ethanol blending began in 2001 with a pilot project that produced ethanol as a byproduct of the sugarcane-to-sugar manufacturing process (Ministry of Petroleum & Natural Gas, 2022). Despite its potential, this initial phase faced challenges, leading to minimal progress in ethanol production until recent years.

A pivotal shift occurred in 2003 when the government launched the Ethanol Blended Petrol (EBP) Programme, aimed at reducing fossil fuel reliance. The program has gradually escalated, beginning with a 5% ethanol blend (Ethanol 5%, Petrol 95%), and currently integrating 10% ethanol into the petrol mix. The National Policy on Biofuels in 2018 initially targeted a 20% ethanol blend in petrol by 2030 under this EBP Programme (Ministry of Petroleum and Natural Gas, 2018). However, the Union Cabinet’s significant amendment in 2022 expedited this goal, aiming for a 20% ethanol inclusion by 2025 (Ministry of Petroleum and Natural Gas, 2022).

Ethanol production in India primarily relied on molasses, a sugarcane processing byproduct. However, this singular route proved insufficient to achieve the 20% blending target (Ministry of Consumer Affairs, Food and Public Distribution, 2023). Consequently, alternative sources such as maize, damaged food grains (DFG), and rice available through the Food Corporation of India (FCI) were allowed to be used for the production of ethanol. The ambitious drive towards the 20% blending target signifies a substantial need for food grains as the feedstock for ethanol production, estimated at approximately 165 LMT (Ministry of Consumer Affairs, Food & Public Distribution, 2023).

Challenges Associated with Grain-based Ethanol

Uncertainty surrounding the availability of adequate feedstock:

The 2021 NITI Aayog expert committee report delineated the staggering requirement of 1,016 crore litres of ethanol to meet the envisioned petrol blending goal (NITI Aayog, 2021). However, the existing capacity of the sugar industry falls drastically short, standing at a mere 684 crore litres annually (ibid.). Consequently, as discussed above, grain-based ethanol emerged as a potential alternative to fulfil this blending target. However, this anticipated solution grapples with the challenge of reliability and sustainability. For instance, there was an abrupt halt in fresh rice supplies by the FCI, after having delivered 13 lakh tonnes to ethanol producers between December 2022 and June 2023, signalling volatility in the availability of crucial feedstock (Business Line, 2023). The halt in supply, enacted to preserve existing stocks, raises concerns about consistent feedstock procurement essential for ethanol production.

Factors such as unpredictable weather conditions affecting FCI purchases or increased allocations towards welfare schemes have not been factored into the optimistic estimates for achieving the ethanol blending target. This uncertainty surrounding feedstock availability raises doubts about the feasibility of meeting the proposed ethanol blending objectives, underscoring a significant challenge in realising this ambitious goal.

Food Security Concerns:

The utilisation of food grains from the central pool for ethanol-blended petrol manufacturing presents a multifaceted issue. Procured initially from farmers at Minimum Support Prices and intended for distribution among vulnerable groups, these grains divert towards ethanol production, exacerbating India’s pressing hunger crisis. Concerningly, with India ranking 111th out of the 125 countries in the 2023 Global Hunger Index, this diversion compounds the country’s food insecurity.

NITI Aayog’s 2021 roadmap advocates a notable shift in ethanol blending strategies by emphasising food-based feedstocks, diverging from the 2018 National Policy on Biofuels, which leaned towards biofuel production using waste biomass. The roadmap asserts surplus foodgrain production sufficiency to meet the ethanol blending target. While appearing feasible initially, this approach remains vulnerable during periods of drought or climate-induced disruptions in agricultural output. Such uncertainties raise valid concerns about the long-term sustainability of relying solely on surplus stocks as a consistent source for ethanol production.

Concerns Surrounding the Shift to Maize

In the fiscal year 2022-23, India produced approximately 4.94 billion litres of ethanol (Saini and Hussain, 2023). This substantial output comprised 75% derived from sugarcane-based sources, while 15% originated from rice released by FCI, 4% from maize, and the residual 5% sourced from damaged food grains, including broken rice available in the open market (ibid.). Despite maize being globally recognised as a primary feedstock due to its lower water consumption and cost-effectiveness, its utilisation for ethanol production remains at a nascent stage within India. Presently, ethanol production in grain-based distilleries primarily relies on Damaged Food Grains (DFG) like broken rice or FCI rice, with minimal emphasis on maize utilisation. The incorporation of multiple feedstocks is envisioned to bolster feedstock security, mitigating reliance on any singular source and showcasing the economic and water-efficient nature of maize-based ethanol.

The government is contemplating increasing maize utilisation for ethanol production, acknowledging its potential dominance in this domain. However, such a shift necessitates a significant surge in maize production to prevent disruption in its current applications in fodder, food manufacturing, starch, and various industrial processes. Meeting India’s ethanol production goals might necessitate an additional 30,000 square kilometres of maize cultivation by 2025-26, raising concerns about sustainable land usage (Worringham, 2022).

Expanding maize cultivation for ethanol poses a conundrum from a food security perspective, given its limited ethanol yield compared to sugarcane. This consideration, coupled with unreliable maize surpluses and the necessity to preserve its multifaceted use, underscores the complexity and challenges of shifting towards maize-based ethanol production in India.

Conclusion

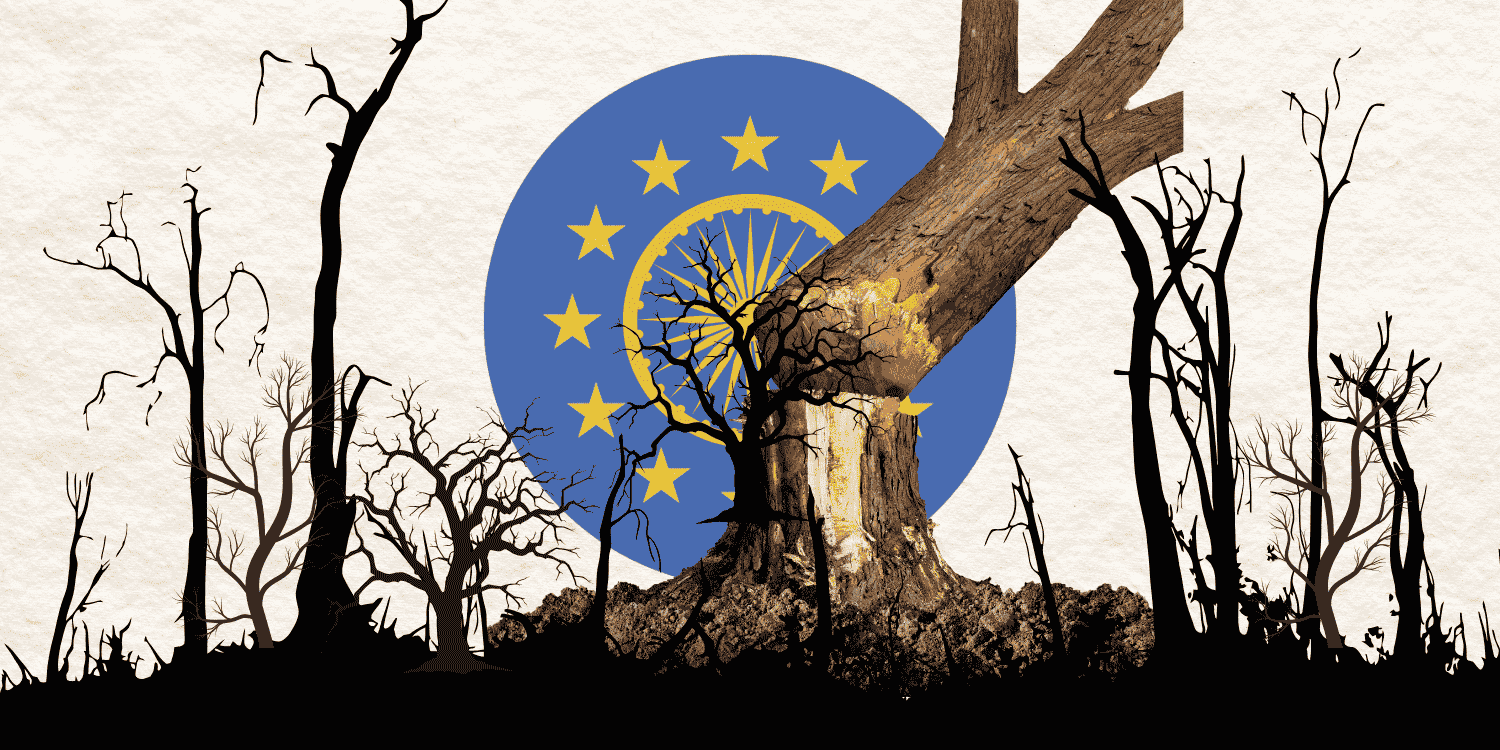

Shifting the blending target from 20% to 10% could potentially align with the existing availability of molasses and sugarcane juice, thereby negating the necessity for additional land or water resources. Instead of pivoting towards maize or other food crops, policymakers should focus on utilising food waste and crop residue for ethanol production.

The global trend of unpredictable weather patterns prompting nations to secure food supplies underlines the need for India to prioritise food security over green fuel initiatives. The wide-ranging consequences of India’s ethanol policy, particularly concerning land use, require more comprehensive consideration.

A critical reassessment of India’s ethanol blending plans, emphasising efficient land utilisation, emerges as imperative. The policy’s profound land-use implications demand thorough consideration, particularly concerning rural sectors and food security. A holistic evaluation encompassing blending levels, timelines, and their impacts on land use and rural challenges stands as a pivotal step in shaping India’s ethanol policy.