Abstract

Exactly 28 years ago, with the Kyoto Protocol; a result of the Earth Summit held at Rio De Janeiro in Brazil, carbon markets came into existence to address climate change, and it established the foundation for carbon markets by introducing market-based mechanisms like emissions trading. Carbon markets allow countries to trade emission reduction credits, incentivizing emissions cuts and promoting a flexible approach to climate action. As countries race toward net-zero emissions, understanding the design and impact of carbon markets is critical, especially for emerging economies. China launched the world’s largest carbon market in 2021, covering 4 billion tons of CO₂ emissions. Similarly, India, aiming for net-zero by 2070, is piloting its carbon market. Studying these models comparatively will help India build a robust, fair, and globally compatible carbon trading system.

Introduction

Carbon markets are trading systems where entities can buy and sell carbon credits, representing the right to emit a certain amount of greenhouse gases, to incentivize emissions reductions and achieve climate targets. These markets are commonly known as compliance or mandatory markets, and voluntary markets allow businesses and individuals to purchase carbon credits or offsets. Both compliance and voluntary markets are growing rapidly, with compliance markets requiring participants to act in response to a regulatory obligation, and voluntary markets allowing non-state actors to offset their emissions to achieve mitigation targets. The Intergovernmental Panel on Climate Change (IPCC) warns that global greenhouse gas emissions are rising, and developing countries need up to US$6 trillion by 2030 to finance half of their climate action goals. Carbon markets are crucial in cap and trade programs, limiting emissions, and assigning limits to participants. The Paris Agreement, an international treaty aimed at managing climate change, was widely adopted in 2015. Carbon accounting, a key component of ESG analysis, is essential for the existence of carbon markets.

Literature Review

India is working on implementing its carbon market and aims to integrate existing mechanisms, like PAT, into it, emphasizing compliance-based reductions. However, according to the Bureau of Energy Efficiency, concerns over the oversupply of credits and enforcement gaps limit its effectiveness. Jain, Deb, and Levitt (2024) recommend a phased cap-and-trade system for India inspired by global emissions trading systems (ETSs). The model mentioned in their paper suggests initially adopting a flexible pollution limit and then transitioning to absolute caps, and highlights the need for mechanisms to control fluctuations, such as price ceilings and floorings. Still, government inefficiency and low initial carbon prices pose challenges. On an international level, the World Bank’s report explains the importance and benefits of interlinking carbon markets as they result in cost reductions and higher efficiency. This paper suffers from the limitations of a lack of quantitative impact of policies adopted by nations such as Brazil and India, as their markets are still in the developing phase.

Methodology

This study adopts a secondary research approach, utilizing an extensive array of credible sources consisting of official government reports, international regulatory frameworks, academic journals, policy papers, and verified news articles. Data triangulation was used to ensure the validity and reliability of findings. Insights were critically assessed to draw meaningful conclusions on pathways for India’s carbon market to integrate with global systems.

Objective

The objective of our study is to understand the structure, working, and legal framework of the carbon market in different developed and developing nations, primarily focusing on India, studying these models comparatively, and extracting various opportunities and challenges for industries and sectors in India in the global carbon market.

Discussion

Market Structure and Functionality

India introduced a carbon market in the Energy Conservation (Amendment) Bill, 2022, to follow the United Nations Climate Change Conference (COP26) as an attempt to reduce fossil fuel consumption. The country aims to achieve a 45% reduction in the emission intensity of GDP by 2030, following the revised Nationally Determined Contributions under the Paris Agreement (Bureau of Energy Efficiency [BEE], n.d.). India has gained experience through programs like Perform, Achieve, and Trade (PAT) and Renewable Energy Certificates (RECs) (Bureau of Energy Efficiency [BEE], n.d.). PAT aimed for energy efficiency by establishing Specific Energy Consumption (SEC) norms for designated consumers (DCs) by providing Energy Saving Certificates (ESCerts), which have achieved 1.412 million tonnes of oil equivalent in energy savings (Kashmir Life, 2025), while RECs represent the environmental benefits of renewable electricity generation. India has shown a substantial increase in installed renewable energy capacity, reaching 220.10 GW as of March 2025 (SolarQuarter, 2025).

PAT experienced issues such as excess ESCerts availability, relaxed targets, and delayed compliance (Kashmir Life, 2025). The latest proposed Carbon Credit and Trading Scheme (CCTS), which intends to expand on the PAT framework, must solve these weaknesses (BEE, n.d.). Under CCTS, there are two mechanisms: The compliance mechanism sets mandatory GHG emission intensity targets for energy-intensive industries and requires obligated entities to either meet these targets or obtain Carbon Credit Certificates (CCC) to make up for any shortfalls (BEE, n.d.). On the other hand, the voluntary offset mechanism gives non-obligated organizations the chance to register projects that produce tradable carbon credit certificates by demonstrating a reduction, removal, or avoidance of GHG emissions (Avaada Energy, n.d.). The government’s ICM is built on a Monitoring, Reporting, and Verification (MRV) framework, designed by the Bureau of Energy Efficiency (BEE) for transparency and accountability. Nine industries have been identified for addition under the CCTS: aluminum, cement, steel, paper, chlor-alkali, fertilizer, refinery, petrochemical, and textile. This will guarantee that these major sectors continue to be fundamental to the growth of the carbon market and significantly contribute to India’s efforts to reduce emissions (Bureau of Energy Efficiency [BEE], n.d.).

We will contrast India’s market with those of other developed and emerging nations, such as China, Brazil, and Indonesia, in order to gain a better knowledge of carbon markets. India can gain insight from Indonesia’s carbon market journey as Indonesia’s carbon market has also been in the developing stage, and both countries have their energy sector as the main source of GHG emissions. Indonesia’s carbon market has a dual structure consisting of a compliance market and a voluntary market. The compliance market currently covers power generation and forestry sectors (mangroves and peatlands), but the government plans to expand it to the manufacturing sector by 2030. Complementing the compliance market is the voluntary market, which operates through carbon crediting or offsetting mechanisms. The Indonesia Carbon Exchange (IDXCarbon), launched on September 26, 2023, is the platform for carbon trading in both compliance and voluntary markets. Under Brazil’s carbon market framework, a dual-structure approach is being adopted, featuring a robust voluntary carbon market already in operation, and a regulated compliance market currently under development. The existing Inter-ministerial Climate Change Committee will oversee the system. The regulated compliance market is being shaped through the development of the Brazilian Emissions Trading System (SBCE), grounded in the National Policy on Climate Change (PNMC). This cap-and-trade system will set emissions caps for large emitters, potentially targeting all the sectors except agriculture. We can see that these countries function with different carbon market structures, but the aim is the same for all: ‘Reducing Carbon Emissions’. The Inter-ministerial Climate Change Committee will oversee its operation.

Legal Framework

A strong legal framework is crucial for understanding carbon markets as it defines the rules, responsibilities, and enforcement mechanisms that ensure transparency and credibility. India’s Carbon Credit Trading Scheme (CCTS) operates under a robust legal framework managed by various bodies, including the National Steering Committee for Indian Carbon Market, Bureau of Energy Efficiency, Grid Controller of India, and Central Electricity Regulatory Commission, ensuring an effective, credible, and transparent carbon market (Bureau of Energy Efficiency [BEE], n.d.). Likewise, Indonesia’s carbon market operates under a regulatory framework led by Presidential Regulation No. 98 of 2021, which establishes the legal foundation for carbon pricing through trading, result-based payments, and levies. OJK Regulation No. 14 recognizes carbon units as securities, therefore allowing international transactions and their trade as per the rules of the capital market. The Ministry of Environment and Forestry manages the SRN-PPI system for project registration and credit issuance. The Ministry of Environment and Climate Change (MMA) oversees climate policy, while the Brazilian Institute for the Environment and Renewable Natural Resources (IBAMA) ensures enforcement.

Adoption of Strategies from Other Countries

These developed and developing nations have implemented some effective strategies that can pave the way for India’s success in carbon markets. From Brazil, India can learn by integrating forestry-based offsets like REDD+, emphasizing natural climate solutions, allowing flexibility for sectors contributing to emission mitigation, and providing incentives to companies working on managing waste production by providing them with extra carbon credits or increased emission caps. Similarly, India can learn from Indonesia by restoring wetlands and mangroves to strengthen its carbon sinks. Expanding agroforestry and linking it to the carbon market can reward farmers while boosting climate goals. Similarly, like Indonesia’s gradual carbon tax, India can start low to balance emissions cuts with economic growth. Community involvement in conservation, as seen in Indonesia, can ensure better results. Carbon market revenues can be used to fund renewable energy and eco-friendly businesses, driving a green transition. Likewise, learnings from China could be the digitalization of MRV systems and Integration with SEBI, Central Electricity Authority (CEA), and real-time Satellite Monitoring. Just like China, India can establish state-level pilot ETS in high-emission states like Gujarat, Maharashtra, and Tamil Nadu. India’s Carbon Credit Trading Scheme (CCTS) can evolve into a cap-and-trade system, especially for the power and industrial sectors.

Challenges and Opportunities in Global Carbon Markets

Article 6.2 of the Paris Agreement allows for Internationally Transferred Mitigation Outcomes (ITMOs), enabling bilateral trade of carbon credits among countries to meet NDCs (UNFCCC, 2015). However, India faces certain structural, regulatory, and operational challenges in aligning its carbon markets with international standards. One of the key barriers lies in the absence of strong and comparable monitoring, reporting, and verification (MRV) systems. While the EU Emissions Trading System (EU ETS) and California’s cap-and-trade system have strict environmental standards, India’s carbon credit trading scheme (CCTS) is still in its initial developmental phase and requires major policy shifts and changes to align its framework well with international environmental standards.

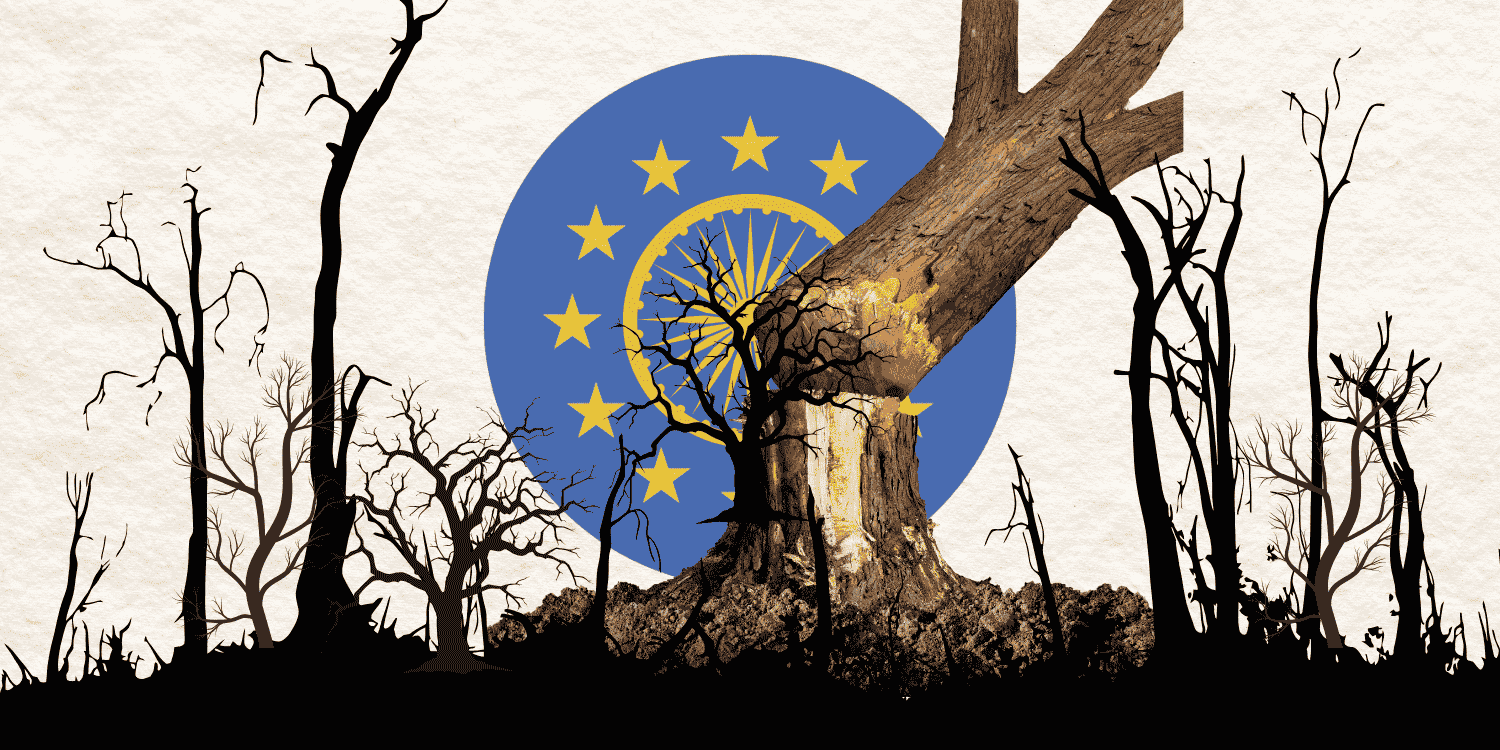

Further, as the European Union recently implemented the Carbon Border Adjustment Mechanism (CBAM), which is set to take full effect in 2026, it introduces certain new challenges. CBAM aims to impose tariffs on carbon-intensive imports such as steel and cement. According to the Global Trade Research Initiative (2023), 27% of India’s iron, steel, and aluminum exports—amounting to $8.2 billion in 2022—were directed to the EU. The CBAM is expected to cause an increase in landed costs in affected categories by 20–35%, significantly affecting the price competitiveness of Indian exports. This mechanism is also designed to prevent carbon leakage, posing a dual challenge of protecting global competitiveness and developing credible carbon pricing for India.

The integrity of emissions accounting is still another major challenge. India must impose strong protection measures to prevent double-counting of carbon credits, which happens when the national government and a private company both claim the same emission reduction, as it links its carbon markets with international carbon trading systems. If India’s National Carbon Markets are to be made legitimate and successful, there is a need for the creation of open and verifiable mechanisms. Finally, India’s limited technological and industrial base in the renewable energy industry is a significant barrier. Despite its ambitious goal of 500 GW of renewable energy generation by 2030, India still relies heavily on imported components, especially polysilicon for solar panels (IEA, 2023). The emerging technologies like energy storage, green hydrogen, offshore wind, and solar thermal are underdeveloped and underfunded. These constraints make it more challenging for India to generate large quantities of high-quality, traceable carbon credits. Though the Production Linked Incentive (PLI) program is encouraging local manufacturing, access to global climate funding, strategic capacity building, and expedited technology transfer are needed for successful integration with the global carbon markets.

Following the discussion on challenges, the focus now shifts to opportunities. Interlinking India’s carbon markets with global frameworks offers many opportunities for industrial innovation, strategic climate leadership, and the production of economic value. As a major supplier in the voluntary carbon market—issuing 278 million credits between 2010 and 2022 (17% of global supply)—India has the potential to expand job creation and employment in green sectors and boost the country’s progress toward its $5 trillion economy goal. Building on its leadership in organizations like the International Solar Alliance, international alignment may strengthen India’s influence on global climate finance. A strong, robust carbon market infrastructure can attract climate finance, thereby facilitating investments in clean energy projects, and supporting India’s transition to a low-carbon economy. This financial influx is crucial for achieving India’s net-zero emissions target by 2070.

By assigning emission reductions a monetary value, connecting India’s local carbon markets to global ETS can encourage a shift towards greener and cleaner energy sources. By reducing reliance on imported fossil fuels, this shift improves energy security while also supporting climate goals. This reduces vulnerability to oil price fluctuations, providing for stable energy prices.

Conclusion

The current analysis points out that India’s carbon market, rooted in mechanisms such as PAT and REC, formed a foundational but initial step towards a low-carbon economy. The upcoming Carbon Credit Trading Scheme (CCTS) marks the shift toward a compliance-based carbon market. Yet its success over the long term will hang crucially in the balance depending upon the credibility of its institutional structure, the clarity of its MRV (Monitoring, Reporting, and Verification) framework, and market efficiency. As India’s carbon market is set to operationalize from 2026, this research serves only as a preliminary evaluation. The evolving nature of carbon markets necessitates continuous empirical studies focusing on credit quality, market liquidity, price discovery mechanisms, and the environmental additionality of projects. Further research will also be essential to adapt regulatory frameworks based on market behavior and global standards.

One of the key recommendations arising out of this study is the strategic linking of India’s carbon market with global platforms. Industrial innovation, strategic climate leadership, the production of economic value, and promoting mutual recognition of credits would allow cross-border fungibility, increase market liquidity, and add to the credibility of Indian carbon credits. Overall, the creation of a national carbon market is a great policy achievement but merely the first step. Careful interconnection with other ETS, regulatory innovation, and quality research will be crucial to make India a confident and effective global player in the emerging carbon economy.